The high-beta pairs with less policy normalization support more vulnerable: The class of currencies that would be most vulnerable from a pernicious shift in the global growth/inflation mix would be those highly geared to global growth and carry-sensitive, but which lack growth upgrades or expectations of policy normalization. This leaves the Antipodeans (AUD and NZD) most vulnerable.

Our 2018 stance for both currencies was underperformance on the idea that growth would be insufficient to warrant any incremental tightening in policy, and would be left behind amid fresh or ongoing tightening from the rest of the G10 world. Moreover, the rise of volatility generally was one specific risk we flagged against AUD in our 2018 outlook, given our observation that it was the rise of vol-adjusted-carry that allowed AUD to outperform its rate spreads last year.

We see further 10% downside for the dollar from here. EUR strength should support the NOK and SEK, while global growth should support the AUD and CAD. Valuation suggests upside risks. PPP valuation considerations certainly matter more than in the past. In the commodity currencies bloc, the CAD is close to fair value but the risk of a spike higher is greater for it than for the AUD or even the NZD. In particular, the Australian dollar is largely overvalued, suggesting that short AUDCAD is an attractive valuation-based relative value trade.

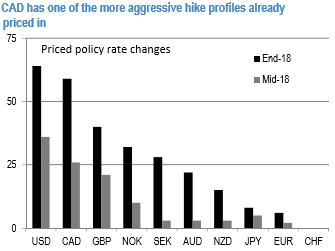

In the G10 commodity space, CAD would also be vulnerable, though less so. Even though our baseline view calls for modest outperformance as BoC hikes 4 times this year, BoC is the second most advanced in its rate hike cycle after the US, with one of the most aggressive profiles of hikes already priced (refer above diagram). And this is overlaid by Canada's overall greater exposure to global growth dynamics due to its large commodity exposure. On this point, NOK is less exposed relative to CAD, given that it has greater scope to be lifted by moves towards policy normalization.

Buy a 6m 0.9950-0.9705 AUD put/CAD call spread:

Our medium-term bearish AUDCAD trade, structured as a 6m put spread, is predicated on policy rate and commodity divergence. However, the trade has underperformed to-date in part on a more general underperformance of CAD on a multitude of non-USD crosses. We think this is most likely due to two factors that should fade in the coming months and continue to hold the position.

Long a 3m 0.9950-0.9705 AUD put/CAD call spread. Marked 0.32%.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying shy above -91 levels (bearish), while hourly CAD spot index was at 42 (bullish) while articulating (at 12:11 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data