Ahead of the ECB March meeting, where another easing package is set to be introduced, spreads look likely to narrow back a bit. Longer out, we continue to see potential for more divergence between the countries.

The Euro-area government bond markets have generally weathered the recent market turbulence well. This is mainly thanks to the ECB's bond purchase programmes. Relative to the moves seen in credit markets, for example, the widening seen in government bond spreads looks very modest.

But the failure to meet market expectations could do more even damage the ECB's deflation-fighting credentials. But the stakes have been further raised by the recent slowdown in economic growth and the return of negative CPI inflation.

The recent news flow has been dominated by renewed deflation fears. One key difference relative to last summer's risk-off environment is that the recent deflation fear is a story in both emerging and developed countries.

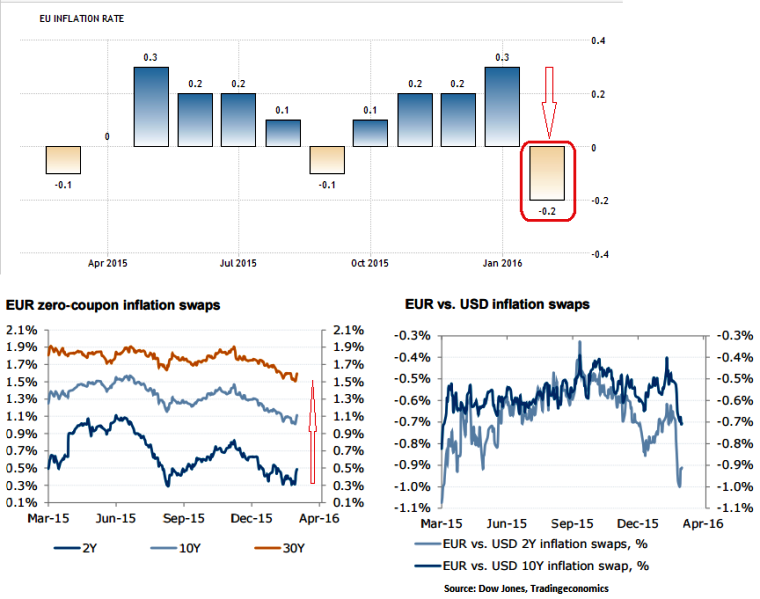

The drop in headline inflation to -0.2% in February was driven in part by further negative energy effects, which will undoubtedly fade later in the year.

After the turn of the year, the following factors contributed to above inflation numbers,

a drop in oil prices below the $30/b threshold and holding stiff at 34 levels again, uncertainty around the level of monetary policy reaction by the PBoC, concerns around the health of banks, and a rate cut into negative territory by the BoJ triggered a global risk-off wave and renewed fears of a US recession.

A zero-coupon inflation swap is a derivative contract, in which one party pays a fixed rate (the break-even inflation rate) and the other party pays a floating rate based on realized inflation.

In the diagram the zero-coupon inflation swap illustrates the average expected inflation rate during the life of the swap, from new year (2016) series these derivatives contracts are likely to yield positive cash flows of all different tenors.

FxWirePro: Deflation fears at extreme level in Euro zone, euro zero coupon and EUR-USD inflation swaps yields on rising mood

Friday, March 4, 2016 9:06 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings