Speculations about early rate cuts in Mexico are increasing: As price data published yesterday showed, inflation continues to decline. In early July it fell to the lowest level in the past two years. That puts inflation at the upper end of the range but within the Banxico's inflation target of 2-4%.

At the same time, growth leaves much to be desired: Seasonally adjusted GDP shrank by 0.2% in the first quarter of 2019, and the second quarter should not have been too excitingly either - the preliminary GDP data scheduled for next week will provide more clarity in this respect.

In view of the gloomy growth outlook, forecasts for the current year are being lowered in many places: This week, the IMF revised its - admittedly so far quite optimistic - outlook and now expects a growth rate of 0.9%, just as we do.

All in all, good inflation data and weak growth numbers increase the chance that Banxico will start lowering key rates by the end of the year as we expect. For the MXN, this will probably mean somewhat weaker levels in the future.

We, therefore, do not reckon the current levels sliding below 18.75 in USDMXN to be sustainable, while the major uptrend remains robust.

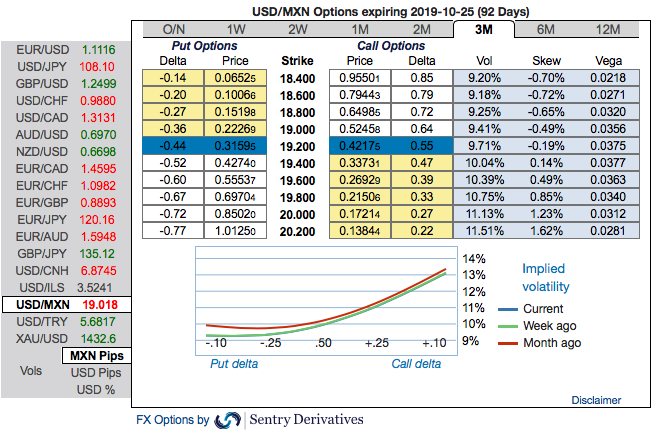

OTC updates: Of late, MXN seemed to be extending recovery threatening upper bound of the recent range. Please be noted that the 3m USDMXN implied volatility skews signal continued upside risks, bids for OTM call strikes up to 20.20 levels. The previous massive sell-off of Mexican peso caused a vol surface dislocation, nudging skews to the highest since the 2016 US Presidential elections. Delta hedged 1*1.5 ratio call spreads exploit the dislocation while also having historically offered a superb performance. +1Y/-3M calendars of risk reversals take advantage of the lagging back-end vs front-end implied skews. Courtesy: Commerzbank & Sentry

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed