CBRT monetary policy may gradually loosen from here. After roughly 350 bps tightening since the start of the year, the central bank may have fewer reasons to maintain such a tight monetary stance in the months ahead. CPI might have peaked in April as core CPI is trending lower and TRY rallied. n Continuing TRY strength will further augment room for CBRT policy normalization, via both decreasing financial stability risks and limiting the inflationary impact of currency pass-through.

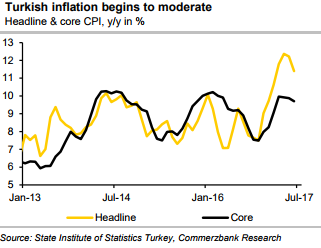

Turkish CPI data for June surprised the markets positively, although one may not see this from yesterday's TRY price action, which was driven more by rising US Treasury yields. But the CPI data themselves were fairly encouraging: the year-on-year inflation rates for both headline and core CPI surprised analysts to the downside; these inflation rates appear to have peaked (refer above chart).

The primary risk scenario is one of potential pressure on CBT to relax its monetary stance. Our own forecast is that CBT will lower its weighted average cost of funding by some 200bps by the end of the year. This should still allow for a positive real interest rate; but, if CBT were to ease policy by a much greater margin, then the lira would once again be exposed to the familiar scenario of sharp, spiraling depreciation. Hence, short 1Y 35D USD puts/TRY calls, delta-hedged, Sell 1Yx1Y USDTRY FVA vs buy 1Y ATM call.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence