It has been one-way traffic for the NZD of late as support levels give way on the back of a stronger USD. There were some hints of stabilisation before the New York close last week, and the PBoC RRR cut over the weekend may help to support risk in the near term. However, much will depend on how Asian markets fare early this week (with China back from holidays). If risk appetites fail to stabilise that would be a poor signal in our eyes and leave the NZD at risk of breaking down towards new multi-year lows. We are quite confident and complacent with our end of year NZDJPY projections at 72.290 levels.

NZDJPY’s trend has been within the tight range of 75.569 – 72.289 levels, but the pair is having more bearish traction and expected to depreciate upto 72.289 levels by the end 4Q’18 as RBNZ outlook remains on hold throughout 2018.

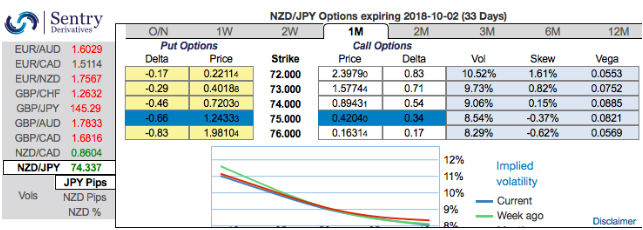

To substantiate this bearish stance, the 1m positively skewed implied volatility indicates the hedging sentiments for the lingering bearish risks. Bids are for OTM puts upto 72.000 levels.

As a result, we construct suitable options strategy favoring slightly on bearish side. Initiate longs in -0.49 delta put options of 2m tenors, simultaneously, short (1%) out of the money put options of the narrowed expiry (preferably 2w tenors), the strategy is executed at net debit.

Well, ahigher (absolute) Delta value is desirable on long leg in the above stated strategy. Whereas, the Theta is positive on short leg; as the time decay is good for an option writer (that’s why we’ve chosen narrowed expiry). The short side likely to reduce cost of hedging with time decay advantage on short leg, while delta longs likely to arrest potential bearish risks.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -114 levels (which is highly bearish), while hourly JPY spot index was at 130 (highly bullish) while articulating (at 07:57 GMT). For more details on the index, please refer below weblink:

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data