We stated it is not going to be steep recovery, now look at the USDJPY prevailing price 120.310 and lows of last week 116.072. The pair was unsustainable holding onto the resistance at 121.50 levels on weekly charts, leading RSI oscillator showing convergence with falling prices.

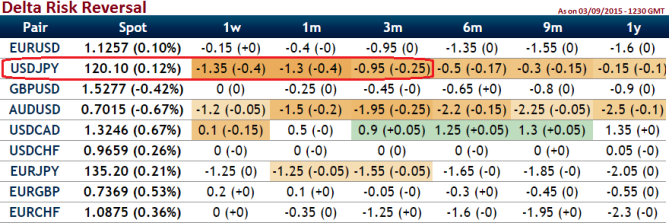

From the nutshell showing delta risk reversal of ATM contracts, it is understood that the ATM put instruments have been on high demand and overpriced which divulges the market sentiments for USD/JPY pair. The hedging activity for downside risks are intensified anticipating from 1 week to next 3 months in it is going in favor of Yen.

If you understand that any call option gives the holder the right, but not the obligation, to buy USDJPY at a predetermined price on a certain date, it's time to think about the other side of that transaction. In order for someone to buy the call option, someone has to have sold the right to that person. The person buying the call option hopes the price of the underlying asset will go up, and the person who sold that person that right is hoping the price will continue to remain the same or slip down and such is the case with USD/JPY.

Trade tips:

In our opinion, it would certainly not be sharp spikes for this pair for sure until Fed's meeting, so keeping this in mind, at the money or out of the money call shorting is recommended as a speculation basis. Thereby, high premiums on call shorting can be certainly locked in as our return. The main objective of writing naked calls is to collect the premiums when the options expire worthless.

FxWirePro: Delta risk reversal alarms USD/JPY’s further slumps

Thursday, September 3, 2015 5:50 AM UTC

Editor's Picks

- Market Data

Most Popular