The RBA surprised by cutting in May, which suggests another cut to 1.5%, probably in August. The RBNZ is expected to cut to 1.75% in June.

With both central banks behaving similarly near term, we would expect the cross to consolidate around 1.08 during the weeks ahead. Multi-month, though, there is a case for higher, towards 1.1300.

Given it is currently well below fair value implied by interest rates, commodity prices and risk sentiment.

Although markets have fully priced in a 2.0% OCR, they are aware the risks for the RBNZ are mainly to the downside and see potential for the OCR to fall below 2.0% if global shocks materialise.

For the day, the local highlight will be the RBA’s Statement of Monetary Policy, from which markets hope to glean signals regarding another possible rate cut. Then tonight it’s the main global event.

Technically, see for more bearish potential upon break below 1.0705 levels. Especially, after rejecting resistance from 1.1243 levels, the pair has broken major supports at 1.1050 and 1.0957 levels with ease, so the major trend is moving in sideways to bearish again.

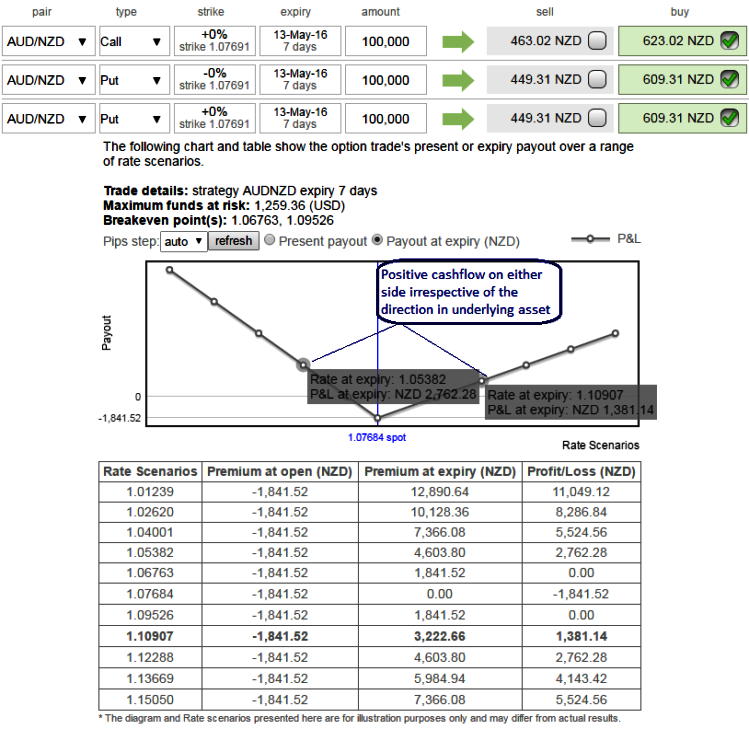

Currency Option Strategy:

The options strips were deployed anticipating more downside potential in this pair, now have a look at the diagram various spot FX rate and their payoff structure. We've been firm to hold on this strategy on hedging grounds. The potential target on upside is about 50-100 pips where 100-130 pips on downside.

The rationale is that any potential downswings should be optimally utilized, so to participate in that downtrend, weights in the portfolio should be doubled with ATM puts.

So, let’s hold 15D At-The-Money 0.50 delta call and simultaneously hold 2 lot of 1M At-The-Money -0.50 delta put options.

Huge profits achievable with the strip strategy when AUDNZD exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move.

Competitive advantage of this strategy: As shown in the diagram the trader can still make money in either way even if the trade anticipation goes wrong - but the underlying pair has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary