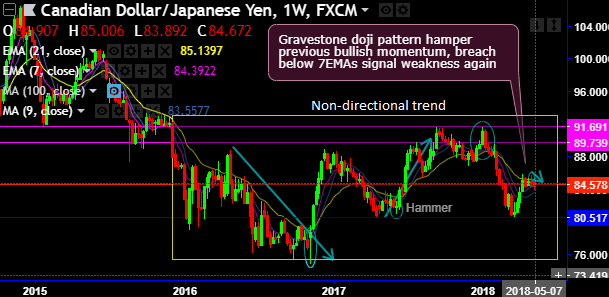

CADJPY is one of the better candidates since recent CAD weakness has undershot recent moves in oil and rate spreads. But any recovery in crude oil prices may cushion CAD in the upcoming days. On the broader perspective, the major bearish trend has now resumed especially after the breach below 21EMAs but remained in a tight range (observe rectangular area on the weekly plotting of this pair).

Contemplating both short and intermediate trend observations, we’ve established OTC indications and advocated options strategy on hedging grounds:

Please be noted that the positively skewed ATM IVs of 2m tenors indicate the hedging interests of OTM put strikes upto 82.500 levels, IVs of these tenors are at 9.74%.

Taking all these driving forces in consideration, we reckon that the underlying pair (CADJPY) has equal chances of moving on either side but with more potential on the downside, accordingly, we advocate options strips strategy on both hedging as well as trading grounds to factor-in all above stated driving forces.

It is wise to initiate longs in 2 lots of 2m ATM -0.49 delta puts, simultaneously, add long in 1 lot of ATM +0.51 delta call of 2m expiry, the payoff function of the strategy is likely to derive positive cash flows regardless of swings but more potential from the underlying spot FX moves towards downside.

The risk is limited to the extent of premium paid to buy the options.

The reward is unlimited till the expiry of the option.

Please note that the options trader can still make money even if he was wrong, that means the strategy likely to derive handsome yields in premiums regardless of swings. But the spot FX has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying shy above 20 levels (mildly bullish), while hourly JPY spot index was at -43 (mildly bearish) while articulating (at 08:04 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data