The dollar is a high-carry currency... Among the currencies of the industrialized countries (G10 FX), the US dollar is the one with the highest interest rate. And it's going to stay that way for now. Isn't that in itself a strong argument for a strong dollar?

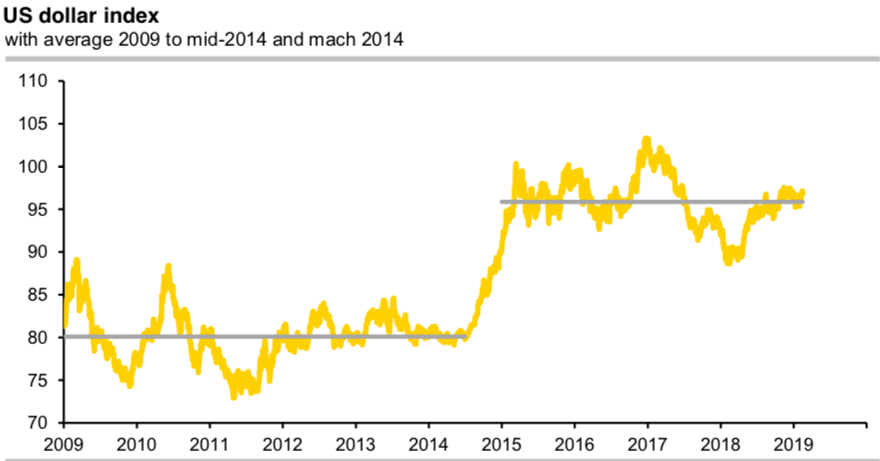

As a matter of fact, it is. However, this fundamental advantage of the dollar has long been priced into its exchange rates. In the course of 2014, it became foreseeable that the Fed would raise US interest rates in the not too distant future, while other central banks (e.g. the ECB and the Bank of Japan) would continue to remain ultra- expansionary for a long time – in some cases more and more. This is why the US currency appreciated at that time. Previously (2009 to mid-2014), the dollar index traded around 80, since the beginning of 2015 it is moving in the area near 95 (refer above chart).

Buy 2m 1.1320 EURUSD put; sell 1.16 EURUSD call for net cost of 11bp. Spot ref: 1.14 levels, while simultaneously maintain shorts in EURCHF at 1.1244 with a stop at 1.1469.

Alternatively, we advocate initiating longs in EURUSD futures contracts of Feb’19 delivery as further upside risks are foreseen in near terms. Simultaneously, shorts in futures of April’19 delivery. Thereby, one can directionally position their FX exposures. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately. Courtesy: Commerzbank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 70 levels (which is bullish), while hourly USD spot index was at -90 (bearish) while articulating (at 08:34 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation