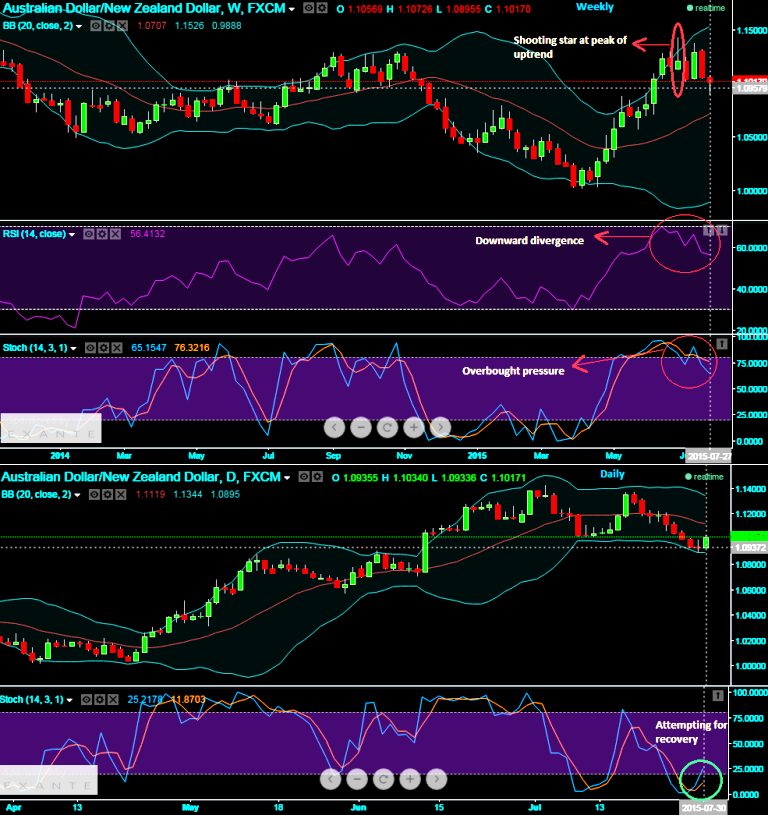

Ever since the downswings are seen on this pair the leading oscillators have been showing downward divergence. RSI trending near 56.6008 diverging with falling prices, while %D line crossover on slow stochastic at around 80 levels signifies selling momentum is continuing. Currently, %D line trending at 76.5986 while %K line at 66.0365 to signify overbought pressure. But as it is sensed that all chances of NZD may look superior over AUD in medium term future, we advise to hedge the Aussie dollar's depreciation through below recommendations.

We've been firm to hold on this strategy on hedging grounds, unlike spreads, combinations allow adding both calls and puts at a time in our strategy.

Hold 7D At-The-Money 0.50 delta call and simultaneously short 1 lot of 15D At-The-Money -0.50 delta put options with positive theta values and one more put option 15D At-The-Money puts after squaring off call option. The rationale being quite simple in near term the pair may experience slight upswing momentum but we foresee stringent declines in medium term future. As one can see from weekly charts how the selling pressure is piling up which should consider our a strategy for longer time frame, however a glance on daily chart would alert bulls for short term recovery which is why we've built strategy involving call with shorter maturity. For hedgers relative values would take care of underlying outrights since option holder will have rights to exercise the obligations.

So the strategy involves buying a number of ATM calls and double the number of puts but the timing of acquiring second put would be after the call attaining its maturity. The strip is more of customized version combination as we maintained less time for call so that the option premiums will have economic pricing and more bearish version of the common straddle.

Huge returns are achievable with the strip strategy when the underlying currency exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move. Hence, any hedger or trader who believes the underlying currency is more likely to plunge downside can go for this strategy.

FxWirePro: Diagonal Strips for both hedging and trading AUD/NZD

Thursday, July 30, 2015 7:21 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings