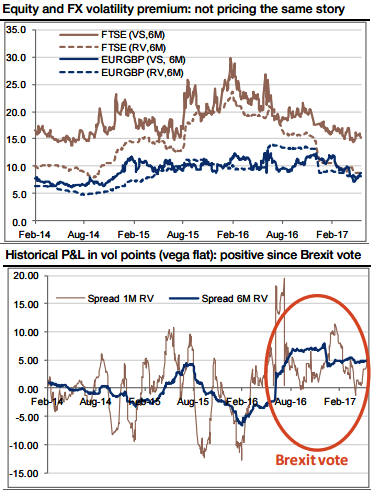

In the UK, we continue to see the Brexit negotiations posing more event risk for markets than the general election result. So, it is worthwhile to keep a track of volatility surface of EURGBP and equity markets of the geography.

The volatility relative value via variance swaps: The 6m variance swap spread between FTSE and EURGBP is currently at 6.3 vol points, but the spread of realized volatilities – the carry – is at 0.7 for the 6m and even slightly negative for the 1m at -0.6 vol points.

We combine the large carry ‘paid’ by the short FTSE variance swap leg to finance the low cost of carrying the EURGBP variance swap leg.

We suggest buying 1.7 times units of EURGBP variance for 1 time unit of short FTSE to achieve a vega-flat structure at inception. We think this is the safe approach, as we see little risk for EURGBP volatility to fall much lower, given that it is at a 2y low and we want to be sufficiently hedged in case of an unexpected surge in FTSE volatility.

Trade mechanism: FX/equity spread of variance swaps, short FTSE Dec-17 variance swap at 15.4, 1 time vega Long EURGBP Dec-17 variance swap at 9.1, 1.7 times vega (GBP notional) Flat spread (indicative bid).

Rationale: The major rationale for this trade has been that the expectations of Brexit to lift EURGBP vol more than FTSE vol.

Risk profile: Equity vol surging more than FX vol Investors going long (short) volatility swap receive the realized volatility above (below) the traded level. However, they must pay the difference between the traded level and realized vol if the latter is lower (higher) than the former at expiry.

Our structure exposes investors to a sharp rise in the equity index volatility, with the 6m FTSE realized volatility ending 1.7 times above the 6m EURGBP realized volatility.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand