The ECB signals of a further loosening of monetary policy at its forthcoming meeting on 10th March.

The abating economic growth should swing the Governing Council to be bolder this time as the December's meeting has disappointed the streets.

So, the expectation on both a 20bp cut in its deposit rate and a €20bn expansion of its monthly asset purchases.

The recent communications from ECB have continued to send strongly dovish signals,

Most notably, President Mario Draghi opened the press conference following January's policy meeting by stating that "it will be necessary to review and possibly reconsider our monetary policy stance at our next meeting" on 10th March. He also turned down a clear opportunity to temper markets' expectations of additional action.

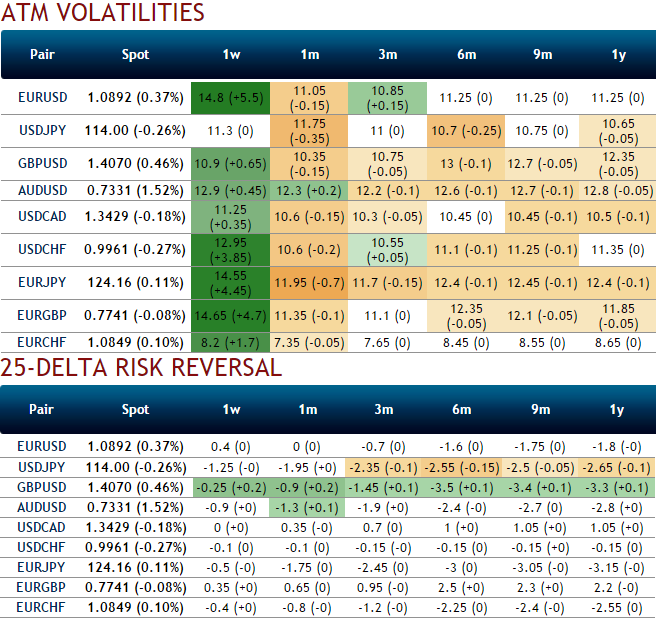

Let's glance over the Euro's implied volatility for 1W contracts ahead of ECB's meeting.

The euro crosses are likely to perceive IVS at almost close to 15% for ATM contracts of 1W expiries.

You can also observe from the nutshell, the same vols of these contracts with 1M to 3M expiries have been shrinking away over 2%.

Ussually, the options with a higher IV would be expensive. This is intuitive due to the higher likelihood of the market 'swinging' in your favour. If IV increases and you are holding an option, this is good. Unfortunately, if you have sold an option, it is bad.

But in the contrary, an option writer wants IV to fall so the premium falls. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

Hence, we think option writers would be on competitive advantage here in these cases of euro crosses. Idea of euro hedging using shorts in right strategies would reduce the cost, for an instance if you are bullish in EUR/GBP then preferring credit put spread or debit call spreads is most likely to derive positive cash flows since these strategies contain shorts favouring bullish swings and so does with EURUSD.

FxWirePro: Do you speculate ECB's dovish tone or stay hedged in euro's uncertainty on mounting IVs as option writers on upper hand?

Friday, March 4, 2016 5:48 AM UTC

Editor's Picks

- Market Data

Most Popular

9