Given the strong probability of higher EUR/USD volatility in the coming weeks, paying a premium for a straddle is less attractive than going long directly via a variance swap.

The highlighted odds suggest taking advantage of a convex profile. Go for the 3m tenor.

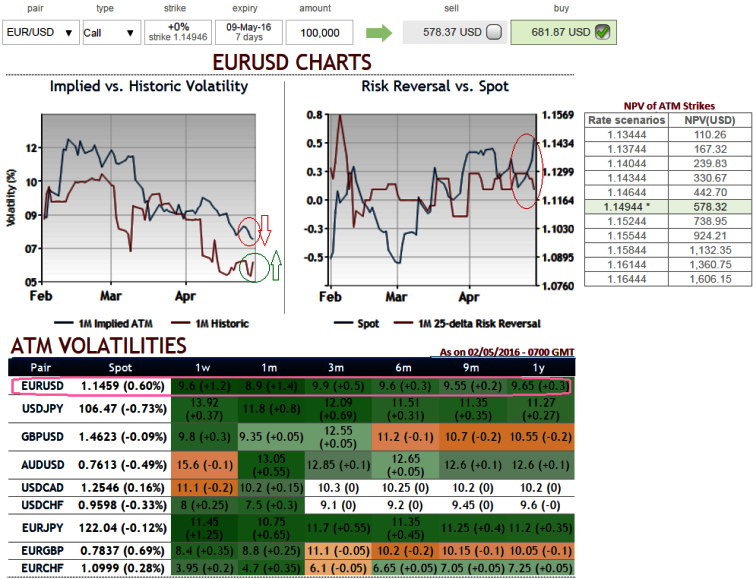

The term structure is low and flat on the 3m-1y segment.

A shorter expiry is a better choice when it comes to going long via volatility derivatives because a short sample gives more weight to the outlier returns in the final pay-off (risk events).

Bounce in realised volatility most likely: Although 3M implied volatility is low, realised volatility is even lower. Approaching 8, it now seems at a threshold between two price-action regimes (see comparison graphs in vols).

With the FX rate returning towards the middle of its range after having failed to break 1.15, it is now unlikely that volatility will experience a regime switch on its own.

The odds favour a bounce in realised volatility, as the spot should remain turbulent.

In particular, the 3m tenor includes the 2 June ECB meeting, the 15 June Fed meeting and the 23 June UK vote.

While a longer sampling period smoothes realised volatility via the averaging effect over time.

1W ATM IVs of this pair is trading at 9.6%, while ATM premiums are trading 18%more than NPV.

Hence, alternatively, go long in EUR/USD 3m variance swap (which allows one to speculate or hedge on volatility of underlying exchange rate.