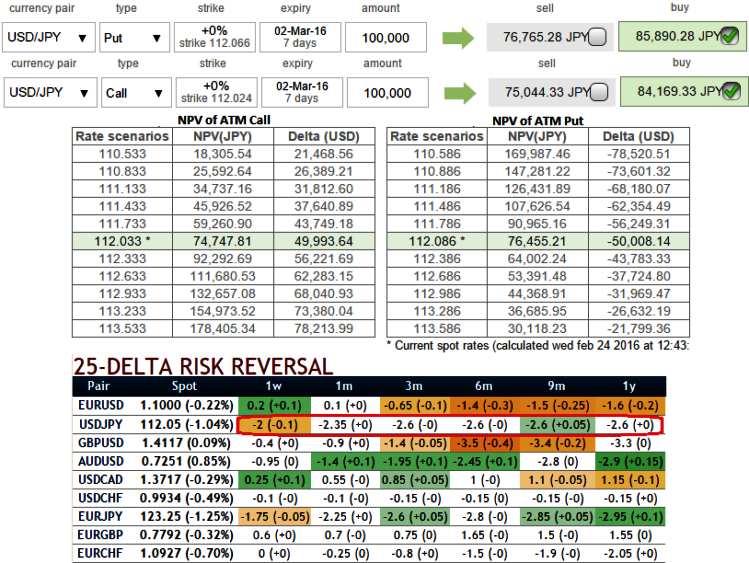

From the nutshell showing delta risk reversal of ATM contracts, it is understood that the ATM puts have been on high demand since hedging activity for downside risks piling up (this is justifiable with the mounting selling pressure in spot FX) but ATM call seems overpriced which divulges the FX OTC option market speculations for USD/JPY pair and that is why we've advocated ratio spreads in the below strategy section. This would be confirmed if you have to observe on an order flow analysis these are nothing but the speculating movements.

It also reveals the hedging activity for downside risks are intensified anticipating from 1 week to next 3 months in it is going in favor of Yen and as you can see in the diagram, ATM calls are relatively overpriced (12.60% more than NPV) while ATM puts are just shy above 12.3%.

With current USDJPY spot is ticking at 111.987, capitalizing on risk reverrsal observation, we come up with below hedging frameworks according to the risk appetite, cost benefits and expectation on leverage benefits.

Place call ratio spread to build Xmas tree, the delta value becomes more and more insensitive as the USD/JPY keeps falling lower and lower and hence on the lower side, the delta value is zero.

Spread ratio: (long 1: Short 2)

How to execute Call Xmas tree strategy: Go long in mid month USDJPY(1%) out of the money +0.41 delta call instrument.

Short mid month USDJPY (1%) in the money call with preferably theta closer to zero.

Short near month USDJPY at the money call with preferably theta closer to zero.

The Call Xmas Tree consists of buying a call at one strike, selling a call at a higher strike and selling yet another call at a higher strike, all within the same instrument and expiration month.

Put doubling construction:

Alteernatively, this strategy is meant for those who are aggressively bearish and expects higher leverage effects in cash inflows with no cost barriers.

Go long in near month USDJPY at the money -0.49 delta put contract.

Go long in mid month USDJPY out of the money -0.27 delta put contract.

Maximum risk involved with this strategy is to the extent of initial premium paid, while returns are unlimited that is indirectly proportional to the USDJPY spot FX.

FxWirePro: Don't rush to buy USD/JPY, instead buy delta risk reversals and stay hedged via Call Xmas tree or doubling puts

Wednesday, February 24, 2016 7:36 AM UTC

Editor's Picks

- Market Data

Most Popular

2