Double whammy to the upside today: The dovish shift by the Fed, and solid NZ GDP data. The USD will suffer near term, but longer term US growth should outperform.

NZDUSD’s rebound in March is mainly a function of US dollar weakness, as markets have backed away from the higher US interest rate view.

However, the medium-term perspective still appears to be vulnerable. The long-held bearish outlook is still imminent, targeting below 0.66 levels by Q3’2019.

OTC Indications and Options Strategists:

Whereas Kiwis dollar’s (NZD) weakness has been prolonged in sympathy with high-beta FX. This led us to slightly lower our NZD forecasts last month to reflect the risk of ongoing negative news-flow relating to EM.

Fed hikes further through 2019 then the USD appreciation is most likely, consequently, NZDUSD will drop.

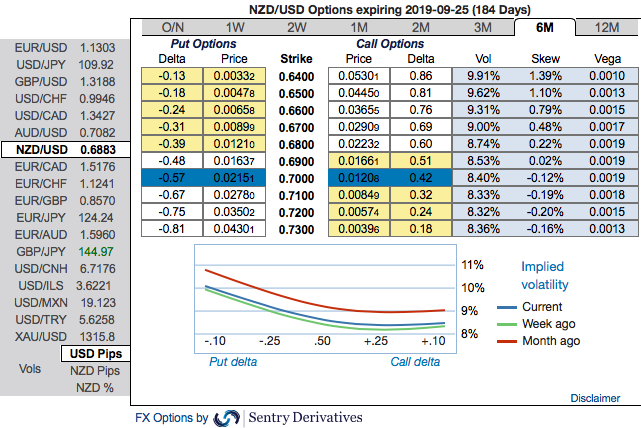

Ahead of RBNZ’s monetary policy meeting (scheduled on this Wednesday), 6m IV skews have clearly been indicating bearish risks. Hence, the major downtrend continuation shouldn’t be panicked the broad-based bearish outlook amid minor rallies.

These positively skewed IVs of 6m tenors signify the hedgers’ interests to bid OTM put strikes up to 0.64 levels (refer above nutshells evidencing IV skews).

We reckon that the global risks play less favorably for NZ than they do for Australia, and the central bank has reason to be credibly dovish even as the data have outperformed some of the downside risk scenarios laid out earlier in 2018. NZD is also expected to depreciate to 0.65 by end of H1’2019.

While the NZDUSD trade is underwater following positive news reports on a US-China agreement. The erratic nature of news flow is one reason why we had suggested NZDUSD shorts via options in the past. 6m NZDUSD (1%) in the money put options have been advocated, in the money put option with a very strong delta will move in tandem with the underlying.

The trade projection is now out of the money but we maintain exposure given tail risks to high beta FX as noted earlier. Courtesy: Sentrix & Westpac

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 64 levels (which is bullish), while hourly USD spot index was at 4 (absolutely neutral) while articulating (at 08:04 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action