The economic outlooks for Brazil and Argentina are significantly better for 2017, but political developments will likely remain fluid.

For now, we reload longs in BRL risk driven by following factors. The BRL slipped around 6.8% against the USD on the month.

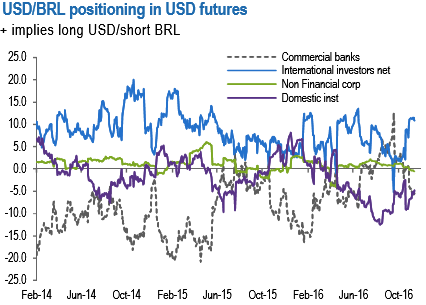

Firstly, positioning has improved (refer above diagram). International investors’ long USD positioning is close to YTD highs in the futures, while local institutional investors also scaled back long BRL.

Second, the short-term valuation models suggest a fairly priced USDBRL to coincident risk indicators.

Third, BCB suggested an acceleration of the easing cycle as Q3 activity continues to depict negative momentum. we have argued although the interest rate differential will be lower going forward, real ex-ante rates (when controlling for country risk) are still significantly above rates versus Brazil’s peers.

Finally, although Brazilian political risk is still lingering, we slightly fade the recent spike in political risk.

We believe the government will be able to navigate the daring waters, although we acknowledge the risk of the second spending cap vote being delayed into next year.

Thus, we go long BRL RV via long BRL/COP (Target: 950, Stop: 860). We also see this as a carry efficient way to short COP.

At the same time, the BRL vol curve has mildly inverted in 1M – 3M expiries such that it has become economically viable to sell gamma hedged with vega longs via vega-neutral short 1M vs. long 3M straddle calendar spreads.

Directional investors not given to delta-hedging can consider buying calendar spreads of USD call/BRL put one-touch options instead of straddles. For instance, short 1M vs. long 2M 3.40 strike USD call/BRL put one-touch calendars cost a net premium of 16% on mid (equal notional/leg). Assuming unchanged markets in a month’s time, the 1M 3.40 expires worthless and the 2M 3.40 rolls up to 40%, resulting in an acceptable static carry/payout ratio of 2.5 times.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics