Yet a central bank can't impose short-term restraint on a financial cycle running for several years. When excesses become apparent, it's too late to act against them. A financial cycle is like a stately container ship; if it is to change course, the captain must bring the wheel round in ample time. This insight should encourage ECB President Draghi: According to our calculations, the Eurozone financial cycle turned upwards at the end of 2015 (see chart on the front page), and both private debt and house prices are on the rise. Now is the time for the ECB to start acting. At the very least, it should end negative interest rates.

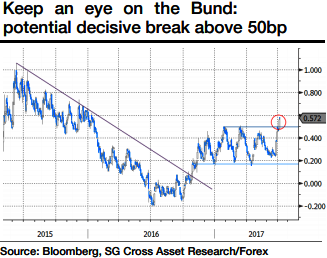

The Bund breaking 50bp could be sending a strong signal to euro crosses.

The bullish impact would be the most direct on the EUR/JPY, as the BoJ suppressed yen rates vol.

Even in the run-up to the meetings it had not been expected that the G20 summit would result in any new initiatives, some of the positions were simply too far apart for that to happen. The EU or eurozone nonetheless used the summit to establish itself as a political force. There have been no signs of tension between the individual countries in the eurozone for some time now. Medium term this new sense of unity is, of course, having an effect on the FX market.

The pair such as EURJPY is still consolidating so the potential reaction is still ahead. The sell-off in the EUR bond market seems to be gaining momentum, as pressure on the ECB to taper and normalize policy is mounting.

This will have growing FX fallout if the German Bund confirms the current tentative break to its 50bp resistance (refer above graph).

Such volatility in the rates market is likely to be transmitted to the FX world via turbulence in EUR crosses.

As a result, the euro range should become more volatile, or the case for volatile topside will materialize – according to SG trade ideas, and EURUSD 6m call strike 1.16 is recommended with a volatility knock-in at 9%.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025