This write-up emphasizes central banks’ monetary meetings under the scanner of the FX derivatives. Please see below a rundown of this week’s key data releases and events with macro relevance:

- The Bank of Japan is likely to dispel policy normalisation expectations

- The US Fed is widely expected to maintain status quo in its monetary policy this week. Forthcoming data would likely reinforce the hopes of further hikes

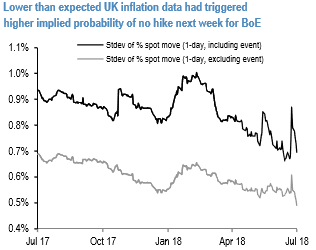

- BoE rate hike is imminent but UK inflation dampens hopes

- Soft Eurozone GDP is likely to be accompanied by an energy-driven spurt in headline inflation

- The Reserve Bank of India is expected to deliver another hike, but it will be a close call

Following ECB on July 26, with a dovish tone by Draghi, who emphasized no rates hike anytime soon till the end of summer 2019, weighing on the EUR, while the spotlight now is on Bank of Japan for this week as the Japanese central bank is scheduled for monetary policy tomorrow. While it is not expected considerable changes – directly raising the 10-year bond yield target or ending the negative interest rate policy. Otherwise, the lingering trade turmoil and EM volatility have caused downside risks to Japan’s 2H growth outlook and exerted appreciation pressure on the JPY.

It is difficult for the BOJ to justify rate hikes at this point without hurting market sentiments on Japan’s growth and reflation prospects. But, we highlight probable BOJ policy tweaks and their implications for US Treasury.

While the FX markets appear to be pricing a rates hike for BoE next week. By looking at the standard deviation, implied from plain vanillas, of the 1-d % spot change including the event (refer 1st chart), lower than anticipated CPI data increased the probability that BoE would be forced not to hike, although that came off in the following week.

The dollar rally began during April and halted in July, dragged down by a flatter US rates curve and by reduced concerns on global growth.

Despite the decoupling exhibited in 1Q-18, VXY Index is historically well correlated with the dollar, with a beta of 97% since 2005 (refer 2nd chart); the pause in the dollar appreciation capped the potential for a marked rise in developed-markets FX volatilities.

X-asset vols trended lower over the past week, in line with a risk-on mode experienced since early July. We reiterate that the picture for EMFX vols, spurred by escalating trade war tensions, has been dramatically different, with the average EM-G10 vol spread at the highest since 2009.

However, the agreement on car tariffs reached between Trump and Juncker on Wednesday might lift sentiment towards EM currencies and support compression of the EM-G10 vol spread.

Potential trigger events:

The week offers a rich agenda of Central meetings ahead of the summer break: BoJ (July 31), Fed (August 1), BoE (August 2). While markets are treating the Fed meeting as a non-event, there has been some hype about the other two in the options market. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is displaying shy above -92 levels (bearish), while hourly JPY spot index was at -32 (bearish) and GBP is flashing at -93 (bearish) while articulating (at 14:14 GMT). For more details on the index, please refer below weblink:

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures