On the verge of French consumer spending and Italian retail sales, today Euro's has been edgy hampering its recent gains again.

The Euro zone aggregate preceded by French and German figures.

Furthermore, ZEW index for Eurozone has been unable to meet our forecast, produced lackluster numbers at 33.9, so this overall Eurozone outlook tends to be overshadowed by the German data released at the same time, French and German PMIs were not that impressive to propel euro.

The data will provide a further read of activity trends in Q4 against a backdrop of comments from ECB officials on whether and what form of further policy easing may come at its meeting of 3 December.

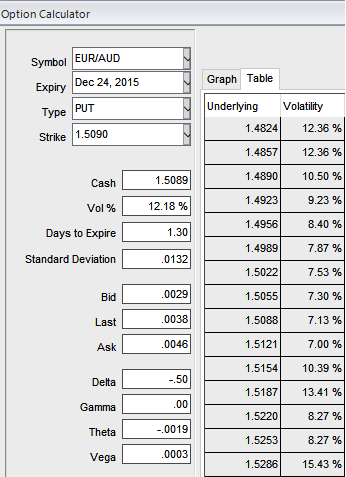

And in addition, as you can make out from the diagram the implied volatility of at the money contracts is seen at 12.18%.

Put holders must be happy with the current levels of this pair (EURAUD spot fx at 1.5090), So any OTM shorts with 2-4 day expiries, handsome profits are on the cards as the price moved above and trend remains to be in sideways and 2 lots of 15D longs of ITM puts that should be on the job with potential dips sooner or later along with OTM shorts to cushion hedging cost, for now more downside potential is seen which is underway in medium term if not instantly.

The recommendation for now is Vega back spread which is generally dominated by the long options the more time there is to expiration and the closer EURAUD is to the strike price of the long options.

15 days of expiration on longs sets up generally the more positive vega the back spread. The reason for this is that far from expiration, the difference between the vega of one strike and the next is relatively small. This is an income strategy. You are looking for a net credit if the pair stays within a range or rises.

In our opinion this pair creates best swing trading opportunity, it is better to use these rallies and stay calm with earlier ITM long puts and any minor upswings can be utilized OTM put writings.

FxWirePro: EUR/AUD bulls seem to be freezed in sideways but high yield IVs offer put writers’ opportunities

Wednesday, December 23, 2015 8:20 AM UTC

Editor's Picks

- Market Data

Most Popular

3