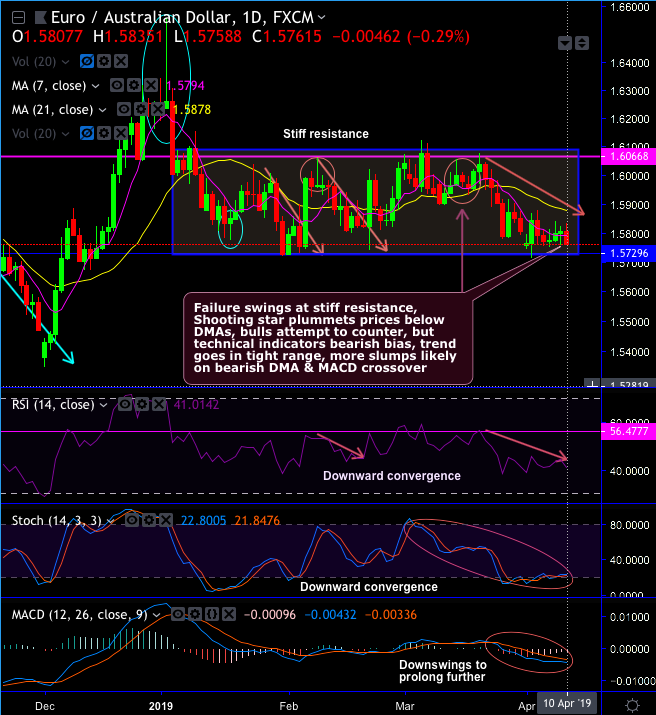

Technical Chart and Candlestick Patterns: Please be noted that EURAUD slumps below 7 & 21-DMAs after the failure swings at the stiff resistance areas of 1.6040 – 1.6066 levels (refer daily plotting).

The occurrence of shooting star at 1.60 levels plummets prices below DMAs, while bulls attempt to counter yesterday, but all technical indicators bearish bias.

Both RSI & fast stochastic curves are showing downward convergence to indicate selling momentum. For now, more slumps are likely on bearish DMA and MACD crossovers.

On a broader perspective, back-to-back shooting stars pop-up at peaks coupled with the overbought signal by leading oscillators, while major trend goes in range but slightly bearish bias (refer monthly chart).

Overall, previous months’ rallies are exhausted and bears resume but the major trend is still stuck in the range with lingering bearish biasness. Hence, the previous upswing seems unlikely to prolong as both leading and lagging indicators are indicating the prevailing bearish sentiments (refer monthly chart).

Trade tips: On trading perspective, at spot reference: 1.5758 levels, contemplating above technical rationale, we advocate boundary options spread with upper strikes at 1.5793 and lower strikes at 1.5730 levels, the strategy is likely to fetch leveraged yields as long as underlying spot FX remains between these strikes on the expiration.

Alternatively, on hedging grounds, we advocate directional hedging strategy as European central bank is lined up for monetary policy meeting today, following the ECB’s surprisingly dovish message last week, signaling no hikes in 2019, we see significantly less upside for EURAUD in the near term, the pair could probably show slumps further in the near term.

Hence, it is wise to initiating shorts in EURAUD futures contracts of Apr’19 delivery as further downside risks are foreseen and simultaneously, longs in futures of May’19 delivery for the major downtrend. Thereby, one can directionally position in their FX exposures. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 153 levels which is highly bullish), while hourly EUR spot index was at 33 (mildly bullish) while articulating (at 08:02 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness