The forecast shows continued tight range-trading in EURCHF over the 1Y horizon. This stability masks a still unstable underlying flow position in which the SNB is recycling all of Switzerland’s current account surplus though persistent FX intervention (the SNB needs to intervene because net private capital outflows are essentially zero).

At current spot at 1.0895, the pair has been oscillating between the range of 1.1199 on north and 1.0732 on the south.

Option-trade recommendation: Strangle Shorting

Considering above OTC market and technical signals we could now foresee the slight price drops that could bring back trend in the narrow range that lasted from 9 months or so.

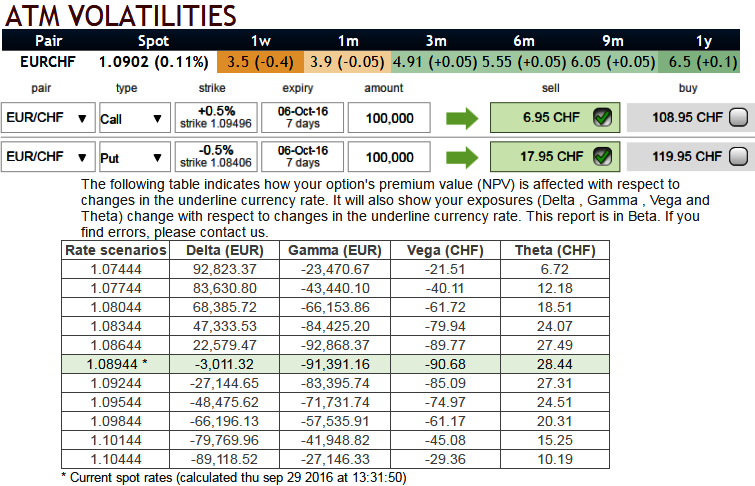

While OTC markets also predict the choppy range to prolong further as you can probably make out from the lower IVs of ATM contracts over various tenors, 3.5% and 3.9% for 1W and 1m expiries respectively (the least among G20 currency space). While 25-delta risk of reversals of EURCHF have been neutral with the no significant hedging sentiments.

At spot ref: 1.0928 with range bounded trend keeping in consideration we would like to remain in a safe zone by achieving certain returns though shorting a strangle.

Naked Strangle Shorting

Overview: Slightly bearish in short term but sideways in the medium term.

Time frame: 7 to 10 days

The execution: Short 1W OTM put (1.5% strike difference referring lower cap) and short OTM call simultaneously of the same expiry (1% strike referring upper cap) (we reiterate, preferably short term for maturity is desired).

Rationale: As per the 2w IV skews do not signify any dramatic change on either direction that would mean that the lacklustre sideway trend to prevail further in near terms. You can be rest assured with the initial premiums that are certain yields as long as the underlying spot fx continue to remain the same range bounded trend.

Risk: Huge losses for this strategy can be experienced when the EURCHF spot price makes a strong move either upwards or downwards at expiration.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts