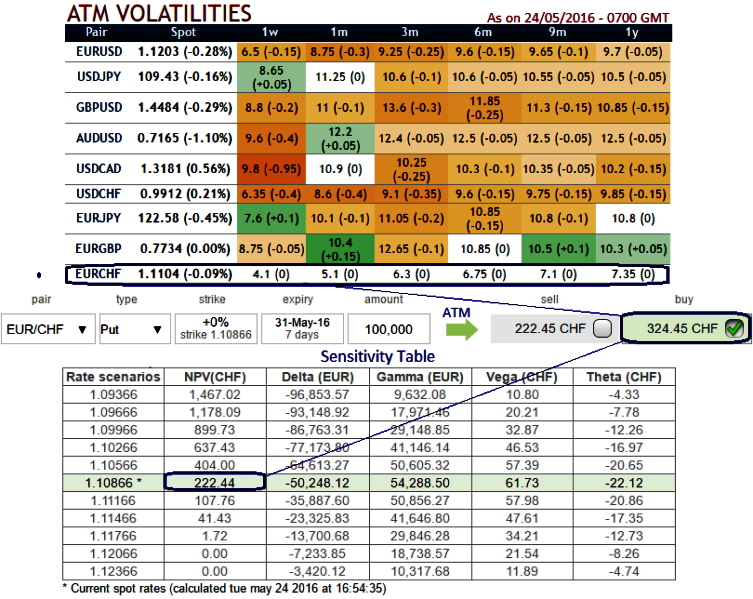

ATM IVs of 1w expiries are just shy above 4%, and likely to pick up pace. Growing in snail's pace even in 3m tenors.

As a result, the delta neutral trading strategy in this case involves the buying of a theoretically underpriced OTM option (because the considerable disparity exists between ATM premiums and IVs as shown in the diagram) while taking an opposite position in EURCHF options.

Well, thereby, a common question pops up after this explanation, "How do I know if an option is theoretically underpriced?" I prefer to use Option Greeks platform that provides this information.

EURCHF ATM put are trading at 31.48% more than Net Present Value.

Comparing reasonable delta contents, ATM IVs and option premiums with net present values of such premiums, will give you the theoretical price of an option.

Here, the implied volatilities of ATM contracts are just above at 6% for next 3 months tenors.

So if anyone anticipates it can still be possible to extract returns from this nerdy volatility scene from this pair, even though exhausted bulls who think long lasting non-stop streak of bull run to take halt at this point. Yes, that's quite achievable from iron butterfly strategy.

To execute this strategy, the option trader assumes long on a lower strike Out-Of-The-Money put and shorts At-The-Money Put simultaneously short again on At-The-Money call and long on Out-Of-The-Money call, this results in a net credit to put on the trade.

At Spot ref: 1.1087, iron butterfly strategy (EUR/CHF) can be executed as shown below,

Long 2M (1%) OTM -0.27 delta Put & Short ATM Put with positive theta or closer to zero + Short ATM Call with positive theta or closer to zero again & Long 2M (1%) OTM 0.27 delta call.

In iron butterfly, there is high probability of deriving certain yields as it contains both bull call and bear put spreads, hence it would likely yield variant payoffs from classic butterfly spreads.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?