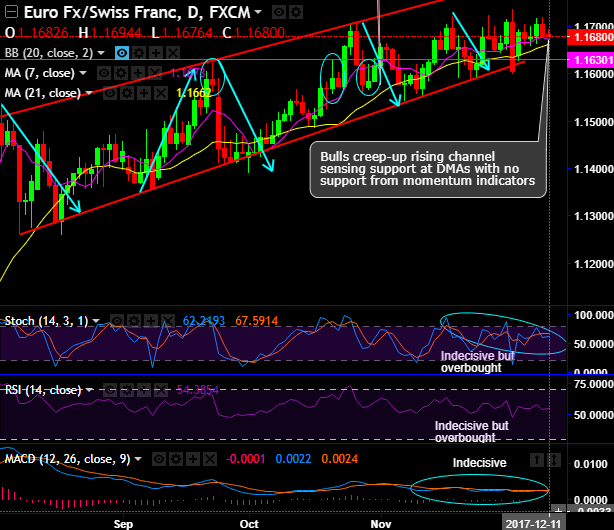

EURCHF short-term trend has been spiking through rising channel, while the bulls in the consolidation phase of the major trend have broken-out the long-lasting range bounded trend. Please observe that the pair has shown the considerable tides and troughs as and when the prices touch channel support and resistance respectively.

Current prices are testing supports at 1.1673 (i.e. 7DMA) and resistance at 1.1715 levels.

For now, we could foresee more upside traction as the current prices are well beyond EMAs with bullish crossover. However, these bull rallies are not supported by the leading oscillators that confirm the momentum.

Both RSI and fast stochastic curves have absolutely been indecisive but signal overbought pressures.

With a trading perspective, one touch binary call options are speculative bets to participate in the potential upswings that are likely to fetch exponential yields than the spot yields when underlying spot FX keeps spiking further.

Subsequently, we formulate suitable hedging framework contemplating all the above aspects. Place call ratio spread with 1:2 ratios.

How to execute: At spot reference: 1.1680, buy ITM (1.1480) +0.66 delta call with longer expiry (let’s say 2m tenor). Sell two lots of OTM strike calls (1.2065) of comparatively narrowed tenors (say 1m).

Thereby, we’ve formulated the strategy so as to sync ongoing technical trend with the bearish neutral risk reversals.

The delta value becomes more and more insensitive as the EURCHF falls lower and lower and hence on the lower side, the delta value is zero.

On the higher side, it increases in magnitude but remains negative indicating the negative effect on the options trader position with the pair rallying.

Why call ratio spread: The pair has been oscillating as you could observe in the rising channel pattern (made slumps and recovery), we see a neutral to the bullish environment when you are projecting decreasing volatility.

Currency Strength Index: FxWirePro's hourly EUR spot index is displaying shy above 89 levels (which is bullish). While hourly USD spot index was inching towards -8 (neutral) while articulating (at 10:16 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: