China’s official manufacturing PMI was weaker than expected at 49.3 in October from 49.8 in September. This represents the sixth consecutive month in contraction territory. The non-manufacturing PMI was also softer at 52.8 from 53.7 previously which pulled down the composite PMI to 52.0 from 53.1 previously. Looking at the details of the manufacturing PMI, the softness was seen across the board, including the leading components.

More significantly, it appears PBOC is also content to let market forces dictate the mid-point and not intervene too much. Today’s mid-point fix was set lower once again to 7.0533 and not far from our model’s forecast of 7.0510. While there is a new twist to the expected signing of Phase One of the US-China trade deal. Chile has cancelled the APEC summit scheduled for 16-17 November where the two presidents were expected to sign the deal. The White House said the US still expects to sign the deal next month but no alternate location has been provided yet.

EURCNH range: By now, it has become consensus that a period of US / China trade truce in the run up to the APEC summit in Chile is bearish for front-end FX vols, especially in CNH where the spate of barely-changed CNY fixings can anchor and extend the ongoing decline in realized volatility. USDCNH 1M ATM vol (currently 4.75) is already 2 pts. lower from its early October high, and it would not surprise us to see it plumb YTD lows a shade north of 3% last observed in early Q3 when the two sides, like at present, were locked in post-Osaka G20 deliberations to resolve the trade dispute. We were fortunate to be relatively early into the trade, when we latched onto the short EM Asia vol theme in September by selling EURCNH digital strangles (selling digital USD puts and calls simultaneously).

Selling digital as opposed to vanilla strangles has the appeal of flooring maximum loss, while EURCNH as a short vol target has the advantage over USDCNH of offering a higher nominal implied vol to sell even as spot is orders of magnitude more disciplined in terms of stationarity / mean- reversion within a more or less trendless range (for instance, a 7.60 – 8.00 range subsumes 80% of the range of the cross over the past 4-yrs).

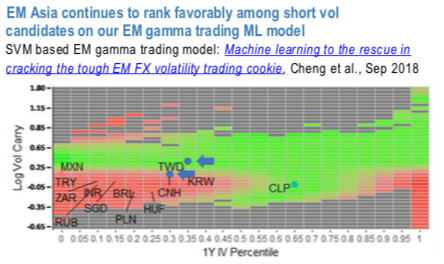

From here, our EM gamma trading ML model continues to see potential for tactically earning some further risk premium in CNH vol despite the markdown in implied vols MTD (refer above chart). With the keenly awaited September ECB now well behind us and broad USD realized correlations starting to bounce off from their recent depressed levels, we prefer earning EM Asia option risk premium in EUR crosses.

Hence, a fresh short EURCNH digital strangle has been initiated this week to replace the earlier clip that expired at a healthy profit (see Model Portfolio Changes). Alternatively, for higher leverage consider 6w EURCNH DNTs (e.g. 6w 7.75 – 7.97 is 24.5% on mids, at spot reference: 7.847). Courtesy: JPM

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics