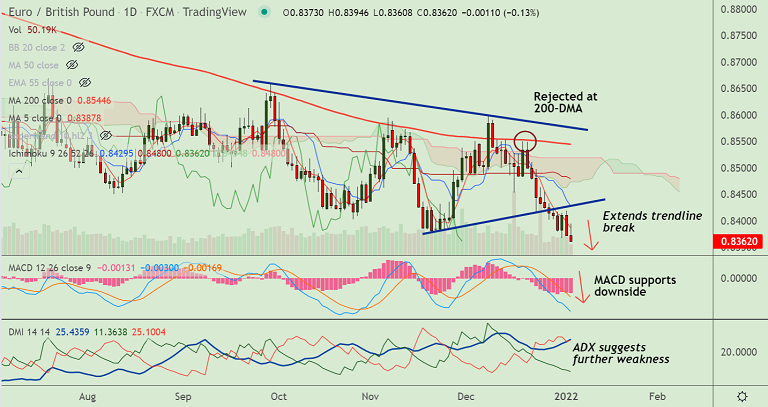

Chart - Courtesy Trading View

EUR/GBP was trading 0.14% lower on the day at 0.8360 at around 11:50 GMT, trades at levels unseen since Feb 2020.

The pair is extending bearish streak for the 5th straight week, hits fresh multi-month lows. Further weakness on charts.

Price action has resumed weakness after a brief pause on Friday's trade, outlook strongly bearish.

MACD shows a strong bearish bias. ADX is rising with negative DMI dominance, adds to the downside bias.

Volatility is high and rising and momentum is with the bears. RSI is well below 50. Stochs are at oversold, but no signs of reversal seen.

Scope for test of 200-month MA at 0.8182 in the near-term. Worsening COVID-19 situation in the UK might slow downside.