EURGBP has upturned an early dip to sub-0.8900 level and recovered around 25-30 pips from session lows. In addition to upbeat EZ PMIs and awaited UK GDP data, we’re trying to figure out if this week’s ECB QE tapering decision is bullish or bearish for the euro crosses and the yield curve is not easy.

No matter how many driving forces that propel the momentary effects on EURO Fx bloc. We reckon that the response will majorly depend on a number of QE parameters that are under ECB review. The length of the QE program extension in 2018 should take precedence over the new monthly amounts the ECB plans to buy from January. A short six-month extension and reduced purchases would be bullish EUR and bearish for rates as this would help markets bring forward a first rate increase.

While BoE expectations have come under pressure this from a combination of lacklustre growth data releases (annual growth in retails sales is now close to 1% compared to +4% when the BoE eased policy last year) together with a stream of commentary from MPC members that reveals a greater range of opinion about the timing of any monetary tightening.

Odds on a November hike have dipped but at 80% still, would mean there’s a clear negative asymmetry in how GBP will react to the last few important data releases before the November MPC as well as additional BoE commentary.

The focus next week is firmly on the 3Q GDP release that is expected to show the economy languishing at a 1.2-1.3% SAAR growth rate.

It’s important to recognize that a less assertive BoE outlook is not the only factor weighing on GBP. In particular, the GBP TWI has now given back 80% of the gains it made following the hawkish September MPC whereas the rate market has retraced by less than a third (based on the Dec 19 short-sterling contract). This disconnect might suggest that GBP is over-reacting; in our view however, it simply reflects the additional leverage of GBP to the lack of progress in the Brexit talks and the increased risk of an accidental no deal.

The substance of the EU Council's summit conclusions on Brexit –that the EU would begin preparatory internal discussions on trade and transition, but further progress would be needed on 'phase one' issues for those talks to include the UK –has been clear for at least a week or so.

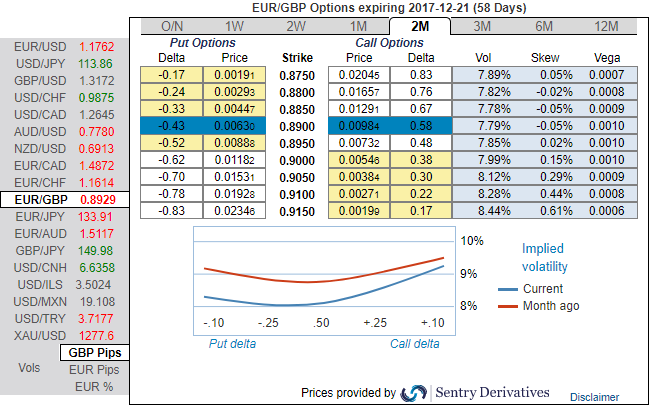

While we expect talks on a transition deal to begin after the December summit, the atmosphere around the negotiations will remain very uncomfortable in the interim and a probable source of intermittent friction for GBP. Long a 2m 0.8875 - 0.9150 EURGBP call spread as IVs of this tenor is spiking higher at 8.1%, while positively skewed IVs signify the upside risk sentiments of hedger, and the risk reversals have been bullish neutral. Paid 52bp September 29th. Marked at 81.6bp.

The prime purpose of short leg on OTM strike is to help pay for the long call's upfront cost. The major advantage of OTM call writing is a higher maximum to the strategy's potential profit.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings