The JPY nominal effective exchange rate first declined to mark a low since early-February on May 22, and in late May, the JPY crosses have rapidly risen amid Italian political turmoil and higher concerns of a trade war and momentarily halted for now.

While the risk sentiment has driven JPY lately, fundamentals provide a partial offset. First, our economists expect a pick-up in global growth led by the US. Firm global growth will likely secure an environment where JPY remains weak as a funding currency.

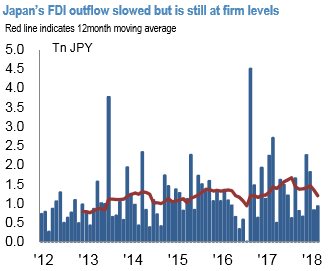

Also, Japan’s net outflow of FDI in 1Q was worth ¥3.6trn. This was 40% smaller than last year but still large in absolute terms (refer 1st chart).

And Japanese investors’ investments in foreign securities were firm from January to April (net purchase of ¥2.1trn foreign stocks and investment funds and ¥2.9 foreign bonds, refer 2nd chart).

Having said that, though Italian politics avoided a worst case, a slew of political events scheduled in coming weeks will still be important to JPY.

Relevant events include the US-North Korea summit (June 12), publication of the final list of Chinese imported goods on which the US will impose a 25% tariff (June 15) and the announcement of investment restrictions and enhanced export controls on China by the US (late June).

Sell 2M EUR/GBP vs. EUR/JPY corr swap, Monetizing re-emergence of idiosyncratic UK policy risk

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -10 levels (which is neutral). Hourly GBP spot index was at shy above 97 (bullish), and JPY is flashing -68 (which is bearish) while articulating (at 06:33 GMT).

For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch