We continue to expect the euro to tick higher into 2017 despite Fed tightening, particularly given the ECB's misgivings about its QE programme. The forecast profile is little changed from the trajectory, the proposed EURJPY forecasts are as follows - Q4 118, Q1 2017 119, Q2 2017 120 and Q3 2017 121.

As occurred in the US before the Treasury taper tantrum in 2013, ECB QE has created a valuation and positioning problem that biases the euro to appreciate on even subtle changes in ECB policy.

Typically, QE programmes drive yields to unjustifiably low levels and encourage investors to accumulate long duration positions in bonds/short positions in FX on the belief that easy money policies will persist indefinitely.

As and when central banks hint that the easing cycle might be ending, the resulting profit-taking prompts massive spikes in bonds yields (+150bp in the US 10-yr during the tantrum) and currency appreciation.

FX Option Strategy:

Buy EURJPY 3m call ladder strikes 117/119/122, indicative offer: 0.22% (spot ref: 114.481)

The structure generates a leverage of about 8x if the EUR/JPY trades between 119 and 122 at expiry.

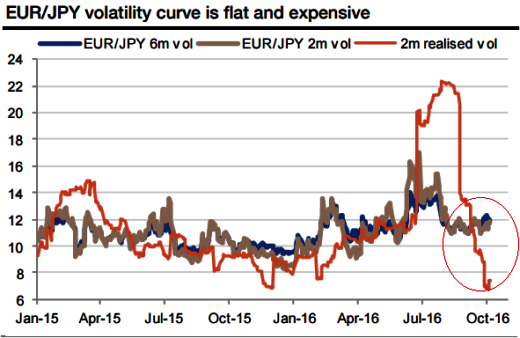

It would also enjoy vega gains on the back of a higher spot, given the negative correlation between the EURJPY and its implied volatility.

The short gamma profile fits the gradual view and keeps a buy-and-hold logic since the maximum leverage will be possible to monetize only very close to or at expiry.

After two months, the mark-to-market is still far from its maximum potential.

But the time passing increases the market value of the package while offsetting the loss breakeven towards higher levels. Any fall in implied volatility also contributes to make the trade safer.

Risk would be unlimited if it spikes above 123.70.

The investors buy a call strike 117, financed by selling two calls with strikes 119 and 122, respectively.

The call ladder structure is selling convexity so that a fast initial acceleration would hurt the mark-to-market. The proposed setup involves unlimited topside risks if the spot trades above 123.70 at the 3m expiry.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch