The mildly constructive EUR projection envisages a belated lessening in cyclical headwinds that should enable a modest EUR momentary recovery in line with the pull from cheap valuation (the REER is 7% cheap to a 20Y average) and record balance of payments support.

But one reason for the Yen’s appreciation when entering a global recession is that investors with speculative JPY short positions face increased volatility and buy back JPY to close their short positions; we note that there was a rapid reduction in speculative Yen shorts leading into the start of the 2008-09 recession in particular, as market recession expectations were re-aligned. From a fundamental point of view the market reaction is understandable.

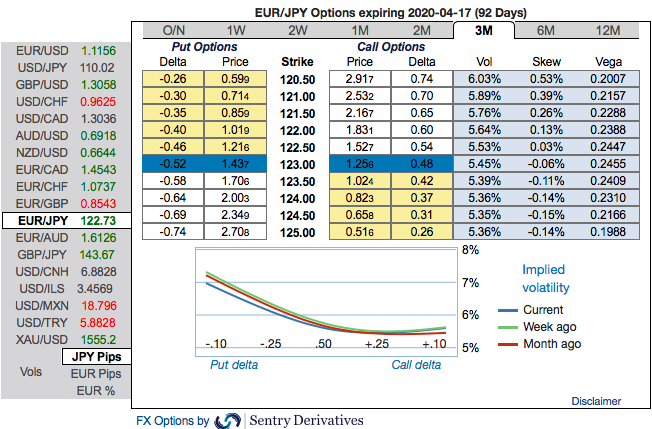

OTC outlook: The positively skewed IVs of 3m tenors are signifying the hedging interests for the bearish risks (refer 1st exhibit). The bids for OTM puts expect that the underlying spot FX likely to show further dips so that OTM instruments would expire in-the-money (bids up to 120.50 levels).

Most importantly, to substantiate the above indications, we could see bearish neutral risk reversal (RR) set-up of EURJPY that indicates the long-term hedging sentiments across all tenors are still substantiating bearish risks amid minor abrupt upswings in the short-term (refer 2nd exhibit). Please be noted that 3m negative RRs suggest the overall OTC hedging sentiments for the further bearish risks. Hence, we advocate below hedging strategy contemplating the current OTC indications.

Options Strategy: Contemplating above factors and the prevailing underlying sentiments, we’ve advocated buying 3m EURJPY (1%) ITM -0.79 delta puts for aggressive bears on hedging as well as trading grounds as the mild abrupt upswings were contemplated earlier.

Short hedge: Alternatively, ahead of ECB and BoJ monetary policies that are scheduled for the next week, we advocated shorts in futures contracts of far-month tenors with a view to arresting potential dips, since further price dips are foreseen we would like to uphold the same strategy by rolling over these contracts for March month deliveries. Source: Sentry, Saxo & JPM

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?