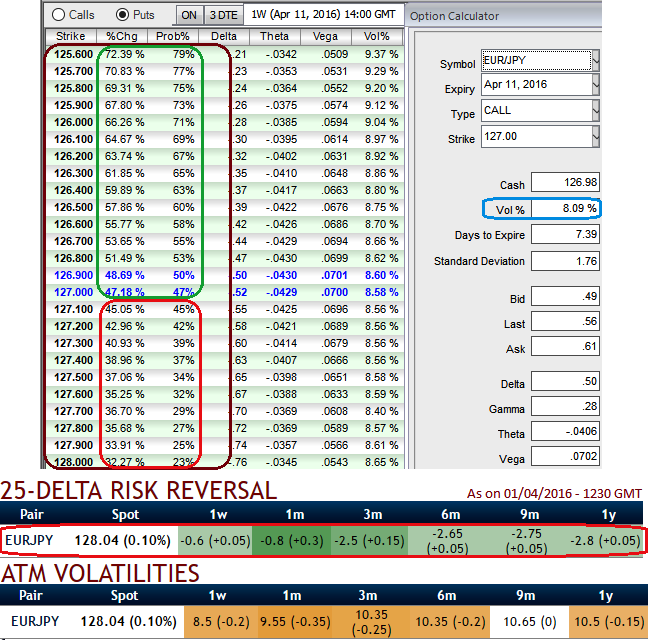

You can observe the reducing hedging interest as current IVs of ATM contracts are collapsing below 8.5%, shrunk away after no significant economic data releases and especially after central bank policies from both euro and JPY sides, but it is likely to perceive at an average of 10.5% in long run that would divulge hedging traction (see 3M-1Y ATM IVs).

As the delta risk reversals of this pair indicates still bearish neutral sentiments in FX OTC markets as there is no hedging interest seen in near terms (see for 1W expiries) but this has again shown in favour of bearish interests as the progressive increase in negative numbers signify the traction for hedging sentiments for downside risks in both short and long term.

Since risk reversal is in bearish neutral, any abrupt upswings could be capitalized to build in shorts with shorter expiries and delta long instruments for hedging downside risks have been favoured by acknowledging the stabilized implied volatility in 3M tenors.

Given concerns on limits of the policy arsenal at the BoJ and rising euro-centric risks, we recommend initiating shorts in EURJPY positions for long term hedging.

As result, deploying as many ATM delta instruments as possible would serve the ideal hedging objectives (as per L.T. risk reversal indication), this would be used to measure the value of an option as the market moves. This is useful to monitor directional risk so you may know how much your option’s value will increase or diminish as the underlying spot FX market moves.

In the above sensitivity table for scenarios of different strikes, you would see the Delta expressed as an amount in the base currency of the pair you are trading. For example, the Delta is an amount in Euros. This Delta value is simply a percentage of the option’s total amount.

As you can probably guess what would be impact on OTM premiums on expiration as they have higher probabilities and also see for the %change in their option prices.

Most importantly, OTM options are always the cheapest options hence buyers pay less and sellers receive less which is why we prefer (1%) OTM strikes in our hedging strategy.

They rely solely on extrinsic value and have a low delta, theta, and vega. A move towards the ATM territory increases the vega, gamma and delta which boosts premium. However, theta (time decay) also increases especially as expiry approaches.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed