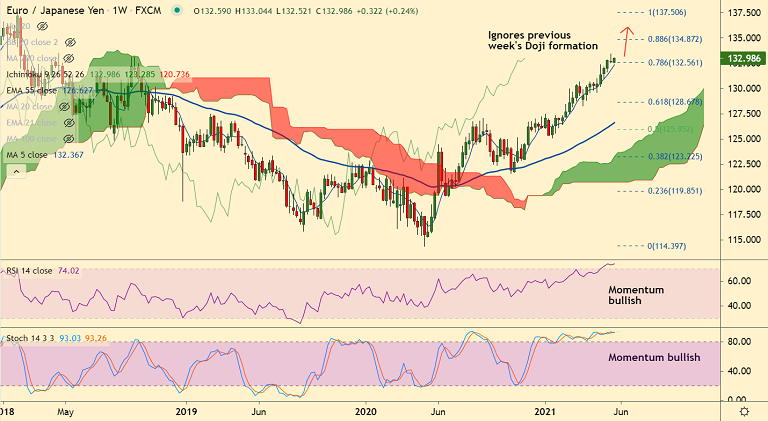

EUR/JPY chart - Trading View

EUR/JPY was trading 0.12% higher on the day 132.96 at around 04:35 GMT, outlook remains bullish.

The single currency found renewed buying interest and rallied to session highs just shy of 133 handle.

The pair has ignored a Gravestone Doji formation in the previous week's candle and has resumed upside above 200-month MA.

Bullish streak extends for the 7th straight month. Breakout above 200-month MA has opened upside.

Stronger economic data in the Eurozone improved the risk appetite and drove market participants towards riskier assets.

The single currency boosted by the upbeat PMI data released last week. Focus now on the German IFO Business Climate for May for further impetus.

Momentum studies are bullish. Price action is extending gains above 78.6% Fib and is on track to test 88.6% Fib at 134.87.