What drives EURJPY’s bearishness:

1) Economic sentiment fell much less than the PMI in March, but this provides only limited comfort

2) Eventual repatriation by US corporates-EUR accounts for a third of foreign profits.

3) Expectations for more hawkish than the expected stance of the BoJ if inflation expectations heighten.

4) EUR appreciation delays ECB policy normalization (change in QE guidance delayed until April).

5) Euro area growth relapses to 2.0-2.5%.

OTC updates:

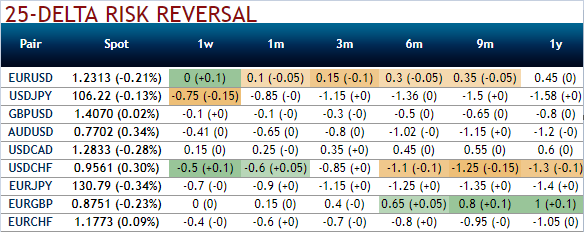

The negative risk reversal numbers are still indicating hedging sentiments for the potential bearish risks across all tenors remain intact, while positively skewed IVs of the 3m tenor signifies the hedgers’ interests in OTM put strikes.

These skews signal underlying spot FX to drop below 126 levels. While glance through above nutshell evidencing risk reversals, although these numbers have been bearish neutral for longer tenor but bearish risk sentiment remain intact on above-stated fundamental driving forces, we can observe the 2nd highest hedging sentiments for bearish risks of this pair among G10 FX space after USDJPY.

Well, to substantiate this standpoint, if you observe the technical chart of this pair, the major trend was rising higher upto 61.8% Fibonacci levels from the lows of 109.205 levels but couldn’t sustain these level, while bearish pattern candles such as hanging man and gravestone doji pop up to signal weakness as leading oscillators indicate struggling momentum. The momentum indicators have been substantiating selling pressures in this consolidation phase (refer monthly chart). For more reading, refer our technical section.

Hence, keeping the both OTC and technical factors in mind, it is advisable to initiate below relative value trades.

Options strategies for hedging:

Buy 2M EUR puts/JPY calls vs. sell 2M 28D EUR puts/KRW calls for directional traders.

Buy 2m EURJPY ATM -0.49 delta puts for aggressive bears on hedging grounds.

Sell 4M EURJPY 25D risk-reversal (buy EUR calls - sell EUR puts), delta-hedged for risk averse traders.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -84 levels (which is bearish), while hourly JPY spot index was at -102 (bearish) while articulating at 07:01 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data