EURO strength on Friday was mainly driven by the EUR side of the equation. The European single currency is quietly recording a very impressive rally, and the only reason this does not become very obvious is that exchange rate levels still contain traces of the previous risk-off moves. And indeed, there is a lot going for the euro at present: wage inflation is rising again, the ECB has taken the first normalization steps (by winding down its asset purchases) and last but not least: politics in Europe are cautiously trying to escape the patronizing US sanctions-policy. A move along these lines on the part of the German Foreign Minister was more than a one-off, as became clear over the past few days. Even if his ideas are not (yet) official German government policy they are another potential factor that would undermine the dollar dominance. The euro would be the only imaginable successor.

OTC outlook:

Most importantly, please be noted that the positively skewed IVs of 2m tenors are signifying (1.55) the hedging interests in the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 124 levels so that OTM instruments would expire in-the-money.

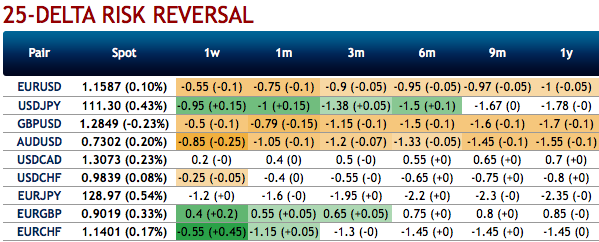

While neutral but negative risk reversal numbers of all euro crosses (especially EURJPY) across all tenors are also substantiating bearish risks remain intact in the long-run.

Technically, we already highlighted both upswings in short-run and raised red flags about EURJPY bearish risks medium-terms. For details, please follow the below weblink: https://www.econotimes.com/FxWirePro-EUR-JPY-bulls-jump-above-21DMAs-after-testing-support-at-382-Fibos--Trade-boundary-strikes-and-short-hedge-1420394

Options strategies for hedging:

Contemplating above fundamental driving forces and OTC indications, at spot reference: 129.146 levels, we’ve devised various options strategies:

Buy 2M EUR puts/JPY calls vs sell 2M 28D EUR puts/KRW calls for directional traders.

Buy 2m EURJPY ATM -0.49 delta puts for aggressive bears on hedging grounds. If expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1.

Sell 4M EURJPY 25D risk-reversal (buy EUR calls - sell EUR puts), delta-hedged for risk-averse traders. Courtesy: investing.com

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 104 levels (which is bullish), while hourly JPY spot index was at -136 (bearish) while articulating at (08:36 GMT). For more details on the index, please refer below weblink:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand