OTC Outlook:

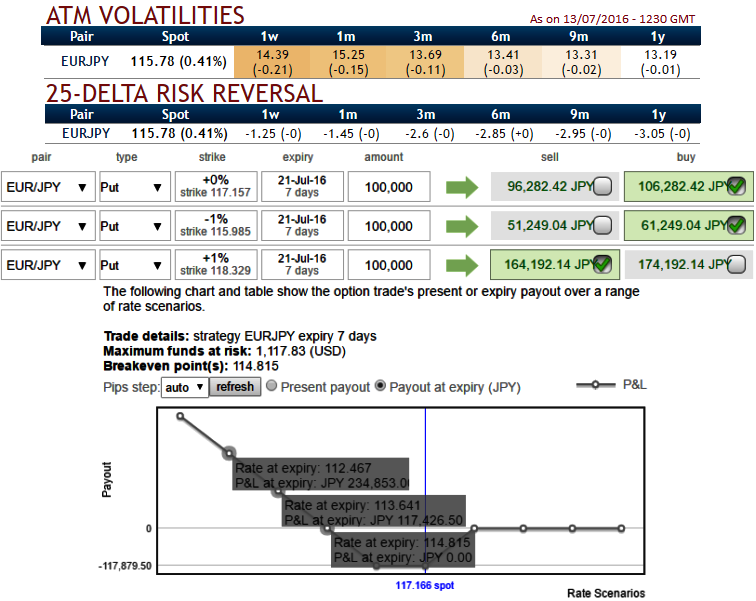

The implied volatility of ATM contracts 1w expiries of this the pair has been remarkably reduced, shrinking at around 14.39% and at 13.69% for 1w and 3m tenors respectively (see above nutshell).

Although the delta risk reversals have been extensively indicating with negative flashes but have new changes have been neutral at this juncture that signifies the hedging sentiments are well equipped for downside risks over the longer period of time but momentary gains that we are seeing from the last couple of days could be optimally utilized in the option strategies.

Thus, we eye on loading up with fresh longs for long-term hedging, more number of longs comprising both ATM and OTM instruments ITM shorts in the short term would optimise the strategy.

We think that the fear of broader global risks now appears to outweigh worries about further ECB and BoJ policy easing. Given concerns on limits of the policy arsenal at the BoJ and rising euro-centric risks.

Why EURJPY put backspread is more efficient in current scenario:

We recommend initiating shorts EURJPY positions for long-term hedging but by capitalizing on short-term upswings that are evident in current technical charts, preferably via options acknowledging the recent upticks in the implied volatility of Euro crosses (see nutshell).

Considering Euro's implied volatility and OTC market sentiments we think more downside risks are still on the cards in the long run, as a result, of deploying ATM delta instruments would be the answer for both speculation and hedging if you think speculation in a potential uptrend in short terms is not possible to sustain.

The purpose of a back spread is to profit on a quick extended move toward, through and beyond the long strike. The purchase of a quantity of more long options is financed by the sale of fewer short options.

But the only danger is that because the short options are closer to or in the money, they might grow faster than the long out-of-the-money options if the underlying spot FX price moves more slowly or with less magnitude than expected. This happens even faster as expiration approaches.

The diagram demonstrates IVs, risk reversals, and payoff structures during various underlying rate scenarios, one can build the strategies alike suitable to their requirements.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary