Option trade recommendation: Straddle shorts

This has been the 3rd consecutive day that we've been firm on our option strategy (straddle shorts) (Ref: "Shorting EUR/JPY ATM straddles yields assured returns and binary puts for speculators" our recent article on 17th July) and it has evidenced as desired. The pair has not made any drastic moves on either side but remained in sideway, this has enabled our traders who followed this recommendation to make certain returns.

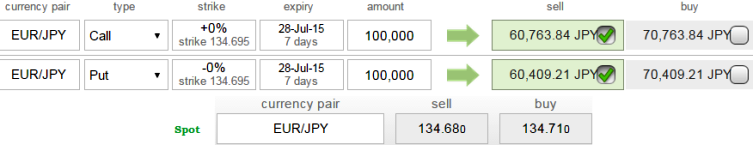

So, imagine traders who entered into above strategy using contracts expiring today would have locked in their profits. If you've to refer the above recommendation on 17th July we advised Short ATM put and ATM call (strikes at 134.959) simultaneously of the same expiry (preferably short term for maturity is desired). Just have a look on the prevailing price of the same strategy; this would certainly lure your trading sentiments.

As we still foresee non-directional trend is puzzling this pair on EOD charts we like to remain in safe zone and recommend shorting a straddle again but this time we expand our range by deploying slightly OTM instruments instead of ATM, thereby, one can benefit from certain returns by shorting both calls and puts.

Maximum returns for the short straddle is achieved when the EUR/JPY exchange price on expiry trades between 134-135 levels only as both the instruments have to wipe off worthless. So that the options trader gets to keep the entire initial credit taken as profit.

FxWirePro: EUR/JPY trend sideways - portfolio evaluation of naked Straddle Shorts

Tuesday, July 21, 2015 6:21 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand