Bullish scenarios:

1) The ECB changes guidance in January/March, heralding an end to QE in Sept and hikes by 1Q’19.

2) US corporate repatriation is weaker/slower than expected,

3) Growth > 3%.

Bearish scenarios:

1) Concentrated, sizeable repatriation by US corporates EUR accounts for a third of foreign profits.

2) Draghi challenges impression of a prospective change to dovish forward guidance.

3) A squeeze on record speculative longs, possibly from a sell-off in global risk,

4) MS5 government in Italy or renewed elections after an inconclusive outcome.

But this list of EUR supportive factors is relatively extensive, which is why we have articulated a high degree of conviction in the forecast for further EUR appreciation.

Well, all these fundamental developments are factored in EURUSD OTC markets.

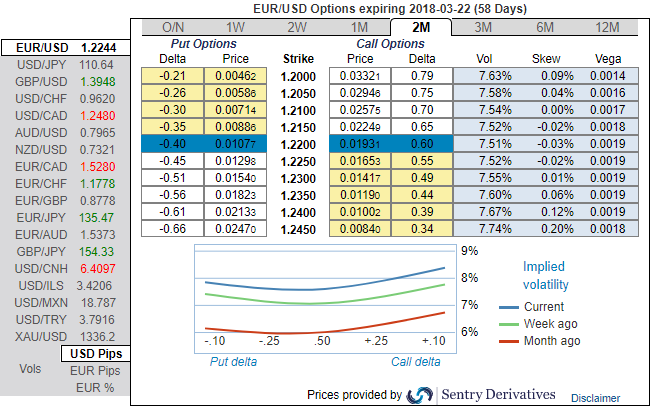

Let’s glance at IV sensitivity tool that indicates mounting changes in the hedging sentiments on either side. This sentiment is substantiated by the positively skewed IVs of these tenors that have been signifying the hedgers’ interests of both OTM calls and OTM puts. Hence, this means that the ATM instruments have the likelihood of expiring in-the-money within their respective tenors.

Hence we advocate buying 3m options strangles comprising of 2m 0.5% OTM calls and 0.5% OTM puts of similar tenors on trading grounds.

Please glance at the payoff structure, as underlying spot FX surpasses barriers. Courtesy: JPM

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand