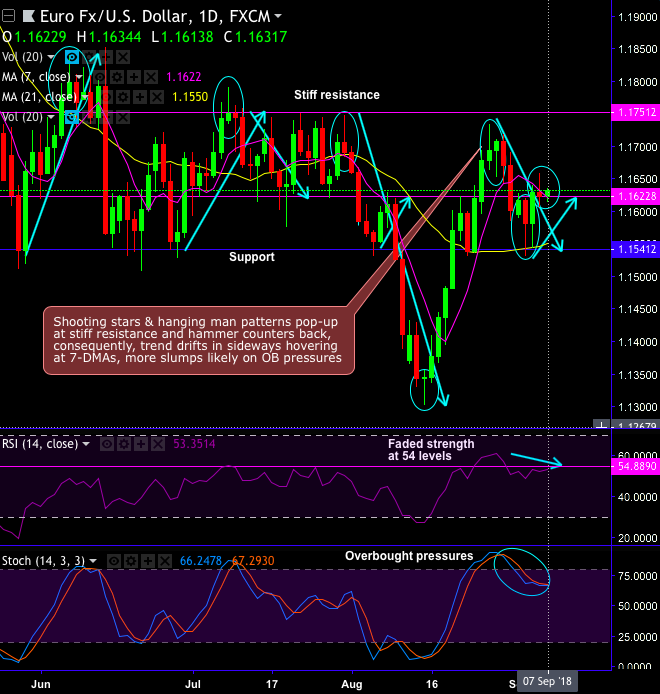

EURUSD forms shooting stars and hanging man patterns pop-up at stiff resistance of 1.1752 and hammer counters back at 1.1541 levels, consequently, trend drifts in sideways hovering at 7-DMAs, trend likely to go in same sideway pattern for the day as both leading oscillators and trend indicators have been indecisive.

As per our long-term analysis, the major trend has been sliding through sloping channel (refer monthly chart), where the shooting star pattern pops-up at channel resistance, ever since then you could make out steep slumps below EMA levels and retraced more than 50% Fibonacci levels of January 2018 highs (i.e. 1.2612) and January 2017 lows (i.e. 1.0371 levels).

You could easily observe, as and when such patterns pop up at the stiff resistance levels, failure swings have taken the downtrend upto channel support.

For now, the major trend is stuck between 38.2% & 50% Fibonacci levels. The current price still remains below 21-EMAs despite ongoing rallies as both leading oscillators signal bearish momentum, in a medium-run, bears are likely to extend 1-year lows, and most likely to retrace 61.8% Fibonacci levels.

Overall, we also highlight 1.0340 as a major low, which bottomed-out the cycle from the 1.60 highs in 2008. We foresee the current medium-term pullback as corrective and expect a broader range to develop. Ultimately, the charts signal an eventual move back towards 1.30-1.35 and then 1.45-1.50 levels.

At spot reference: 1.1637 levels, contemplating above technical rationale, one can bid upper strikes at 1.1677 (21EMAs) and short lower strikes at 1.1613 levels to construct boundary options spread, the strategy is likely to derive exponential yields as long as the underlying spot remains between these two strikes on the expiration.

On hedging grounds, initiate shorts in futures contracts of mid-month tenors with a view to arresting bearish risks.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 9 levels (which is neutral), while hourly USD spot index was at 6 (neutral) while articulating (at 06:25 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

These indices are also conducive for the above trading strategy.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data