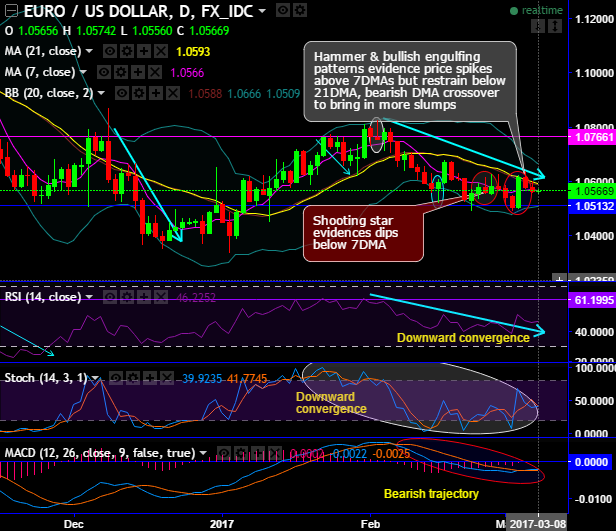

Hammer & bullish engulfing patterns occurred at 1.0599, 1.0557 and 1.0620 levels respectively.

The pattern candles have shown their bullish effects subsequently in price spikes above 7DMAs but restrain below 21DMA, bearish DMA crossover to bring in more slumps (refer daily charts).

Thereby, we can foresee the weakness in this pair with the repetitive struggles at DMAs with bearish DMA crossover to bring in more slumps (daily charts).

In a broader perspective, shooting star patterns occurred even at 1.1088 and 1.1575 levels on monthly plotting which is well below 21EMAs.

As the interim bulls seem to have exhausted at 7-EMA (see monthly), we call for more slumps rather than bulls extending rallies upto channel resistance.

EURUSD major trend has been sliding through sloping channel (monthly terms). While last two days the downswings are dragging below 7DMA despite the engulfing pattern that could be deceptive to the aggressive bulls as the momentum is losing in its traction (see daily charts).

Although EURUSD spiked from channel support, it has remained well below and been struggling to bounce further above 21EMA levels on a monthly chart; as a result, the major downtrend still seems to be intact.

RSI on both daily as well as monthly terms indicates convincing strength in declining trend downward with its convergence to the prevailing price declines.

While stochastic curves have been indecisive but bearish bias at oversold zone (on both dailies and monthly terms).

Same has been the case on MACD, this lagging oscillator indicates indecisiveness on both daily and monthly terms but remains bearish biased on both timeframes.

Hence, it is wise to snap rallies to deploy fresh shorts as you see no traces of indications of the robust uptrend for now, instead trace out selling momentum on shorter term charts.

Trade tips:

Well, contemplating above technical reasoning, on speculative grounds we advise tunnel spreads which seem like a binary version of the debit put spreads.

At spot reference: 1.0566, this strategy is likely to fetch leveraged yields than spot FX and certain yields keeping spot levels as upper strikes and lower strikes at 1.0513 levels (around 40-50 pips on southwards).