FX vol implications of the ECB decision are murky.By muddying the Euro's hitherto clean anti-USD plus political stress narrative for Q1, there is a case to be made that ECB’s soft taper potentially crops the extreme left tail of the spot distribution for next year, restricts currency ranges and lowers realized volatility.

FX gamma in that event should mirror the bearish reaction in Euro rates gamma that will continue to be hamstrung by a policy-enforced lid on front-end yields.

On the other hand, tension between competing macro influences may not offer perfectly synchronized offsets on a day-to-day basis, especially when one of those drivers (US fiscal) is a high risk policy item; in that case, a disciplined range on spot, while certainly not conducive to wildly higher realized vols, may not dampen them enough to make gamma ownership wholly unappealing for active delta-hedgers.

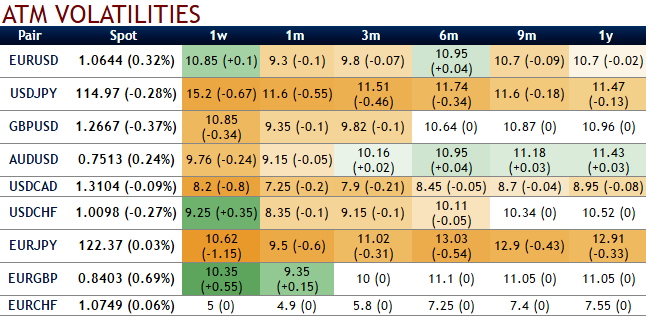

This leaves short-dated EUR vols in something of a limbo: marginally softer in the baseline, but subject to intermittent noise/spike that makes strategic view-taking difficult.

Longer-dated implied vols, especially expiries spanning the Dutch and French elections should, however, prove to be a more reliable.

Most importantly, after a prolonged duration of downgrades to the dot plot, the FOMC modestly tweaked up the profile after delivering 25 bps hikes in its funds rates. Three 25bps hikes are now expected in 2017, up from two.

The persistent store of event risk premium and relatively immune to tactical gamma developments, hence, 1y EUR vol remains one of our core vega longs for next year.

You could also observe that the mounting risk sentiments of downside hedging from the nutshell evidencing IVs and risk reversals of EUR crosses.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX