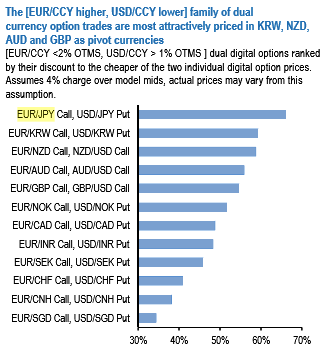

With limited room for Euro appreciation and the near certainty of a vol slump in the event of a Macron victory, long delta/short vega strategies such as EUR call flies appeal, and are well-priced in EURUSD and EURCAD. Higher leverage expressions of Euro strength are [EUR/CCY higher, USD/CCY lower] and [EURUSD higher, EuroStoxx higher] dual digitals.

Baskets of EUR-crosses that rally alongside EURUSD do not offer much by way of correlation savings since EUR based correlations have climbed appreciably this year. A more effective tactic is to decompose EURUSD into a EUR-cross and a USD-pair and bet on their de-correlation. For instance, EURAUD can be reasonably expected to track the broad EUR-uptrend even as AUDUSD remains flat/inches mildly higher in a risk-friendly post-Macron environment.

The option pricing clincher is that AUDUSD vs. AUDEUR implied correlations are marked at 52%, so clearly not priced for such divergence in two traditionally well-correlated AUD pairs. The above chart runs through a pricing exercise of this family of structures across various pivot currencies and shows that KRW, NZD, and AUD offer the best value.

Since the broad dollar is trading meaningfully cheap to rate differentials, USD legs in this set-up need be struck more conservatively (ATMS) than the EUR-cross.

2M [EURKRW > 1% OTMS, USDKRW < ATMS] dual digital costs 13.1/16.5% KRW indic. (indiv. digis 41.8% and 51.4% respectively).

2M [EURNZD > 1% OTMS, NZDUSD > ATMS] dual digital costs 15.2/18.7% NZD indic. (indiv. digis 44.3% and 52.8% respectively).

2M [EURAUD >1% OTMS, AUDUSD > ATMS] dual digital costs 16.8/20.3% AUD indic. (indiv. digis 43.3% and 54.1% respectively).

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise