The EUR/USD pair halted its rise on Friday as US dollar strengthened across the board after data showed a pickup in US wages in January. The pair initially rose towards 1.1250 levels, before slipping back towards 1.1130 levels.

- The pair continues to remain in bullish tone, despite the euro losing some ground against dollar in the early US session.

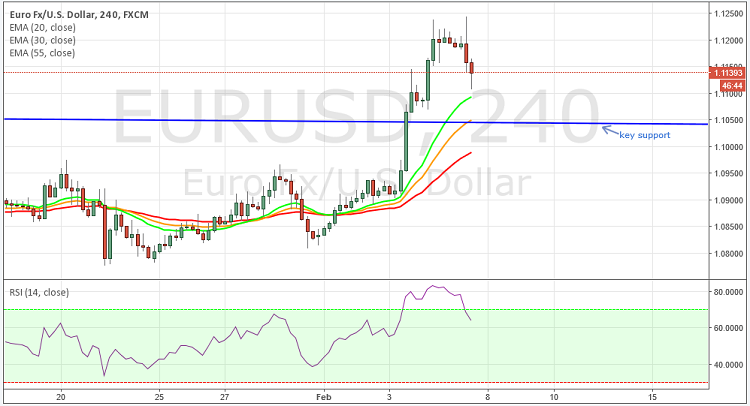

- Technically short term picture depicts bullish trend for this pair, as the RSI in the 4 hour chart is positive territory at 62. The 55 30 and 20 MA's are also pointing towards upwards. Overall the technical indicators are depicting more upside for this pair.

- To the upside, the strong resistance can be seen at 1.1217, a break above this level would expose the pair to next resistance level at 1.1247 levels.

- To the downside strong support can be seen at 1.1045, a break below at this level will open the door towards next level at 1.1000.

Recommendation: Go long around 1.1070, targets around 1.1140/1.1200, SL 1.1000

Support levels: 1.1130, 1.1108, 1.1046

Resistance levels: 1.1165, 1.1217, 1.1247