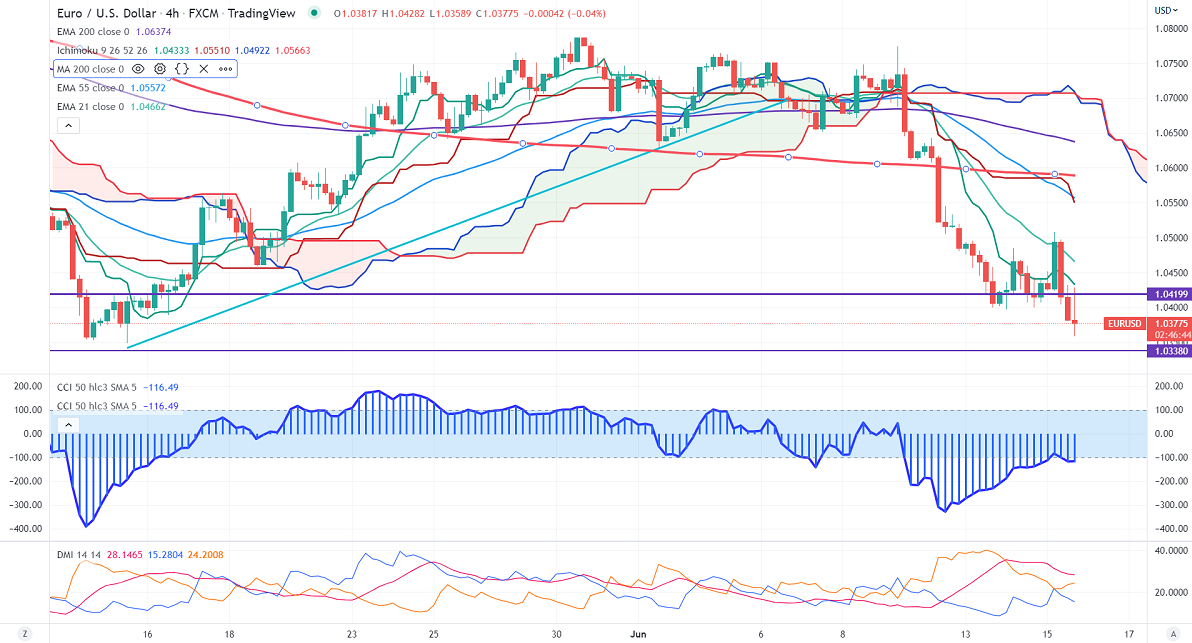

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.03936

Kijun-Sen- 1.03936

EURUSD declined below 1.0400 after Fed monetary policy. The central bank hiked rates by 75bpbs compared to a forecast of 50bpbs, the biggest hike since 1994. It has revised PCE inflation to 5.2% this year from the previous 4.3% and reduced GDP to 1.7% from 2.8%. US 10-year yield gained slightly by 5 points to 3.113%. EURUSD hits an intraday low of 1.03580 and is currently trading around 1.03973.

Technical:

On the higher side, near-term resistance is around 1.0500 and any convincing breach above will drag the pair to the next level of 1.0570/1.0600/1.0650.

The pair's immediate support is at 1.0340, breaking below targets of 1.0300/1.0250.

Indicator (4-hour chart)

Directional movement index – Bearish

It is good to sell on rallies around 1.0428-30 with SL around 1.04885 for a TP of 1.03000.