The much-awaited ECB QE recalibration exercise ultimately announced yesterday, but it contained very few surprises after a meticulous 6w build-up and ended in a virtual stalemate for FX and rates markets, with EUR crosses fluctuating lower but within recent ranges and the rates complex flattening fractionally at the long end. If it ever was the objective to dash speculation of a rate increase before 2019, the ECB succeeded with verve.

On forward guidance, the ECB made clear that interest rates will stay at their present levels for an extended period of time, well past the horizon of the “net” asset purchases.

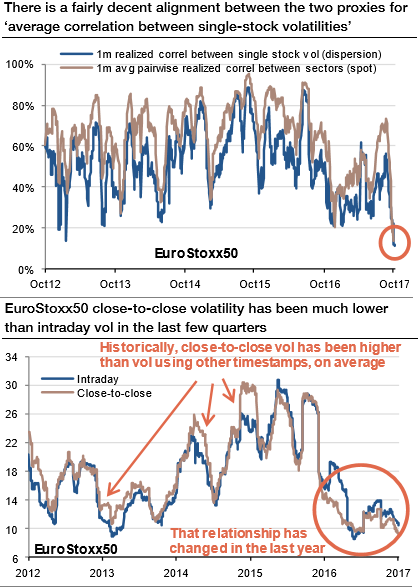

Volatility across all indices in Europe has continued to sink slowly as if pulled down in a quagmire. That may be a fitting analogy because volatility has been sticky and on a downward trend through the year. The 1-month realized volatilities on the CAC40, DAX30 and SMI indices have reached their lowest levels since the inception of these indices, while the volatilities on EuroStoxx50, SMI and AEX are close to all-time lows. Long vol positions have been painful to carry for a while, and unfortunately, investors may be looking at more of the same for a while.

To simplify and approximate in a Black Scholes model, gamma is inversely proportional to volatility and gamma of options increases when volatility decreases (Refer above chart). This is understandable as gamma is defined as the change in the delta of the option for 1% move in the spot and the second order sensitivities are going to be larger for a 1% move in an environment which is currently experiencing c.30bp moves a day (5% realized vol). Nevertheless, it is worth looking at the charts below to visualize the scale of the increase in gamma and what it means for subsequent hedging from dealers.

As seen in the chart below, gamma becomes much more concentrated around the ATM in a low vol environment, leading to a 4x times increase in gamma sensitivity as vol decreases from 20% to 5%.

Our largest net position is long EUR against USD, GBP, and CHF. The ECB taper announcement is expected to be marginally constructive for EUR, the European central bank hasn’t delivered fireworks as expected.

Option pricing of the October ECB event risk is a tad expensive since the outcome of a slower-for-longer QE extension, and given the recent history of consistent under-delivery in EUR-crosses on ECB meeting dates. The post-ECB rolldown in short-dated EURUSD implied vols is overstated, and there is much better value in owning 1M forward volatility after the event.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data