You see higher and steeper 6M-1Y EUR vols: you could make this out from the IV nutshell, rising hedging interests during this span.

Europe faces one constitutional referendum (Italy in December) and three to four national elections next year:

Netherlands in March, France in April/May, Germany by October and possibly Italy.

There are good reasons to think that eventual ballot box outcomes will buck the current populist trend and turn out Euro-benign

Trump shock will now pull forward that time table, lift 6M-1Y expiry EUR vols that span European election dates, and bull-steepen the vol curve even if shorter- expiry implieds remain well-anchored by tight ranges on spot Euro.

Fundamentally, Euro area composite PMI post a solid gain in October, signaling 1.8% ar GDP growth

Improvement was broad-based by sector and country and was reinforced by IFO and EC surveys

Q3’16 GDP report prints unchanged numbers at 0.3%, SAAR growth, with modest downside risk. October flash inflation report to show core inflation stuck at 0.8% oya.

The baseline remains that a chasm will open up in coming months between reserve currencies (EUR, JPY, CHF and gold) and non-reserve ones as trade friction and US sovereign risk issues resurface to undermine the dollar against the former and inject risk premium into the latter.

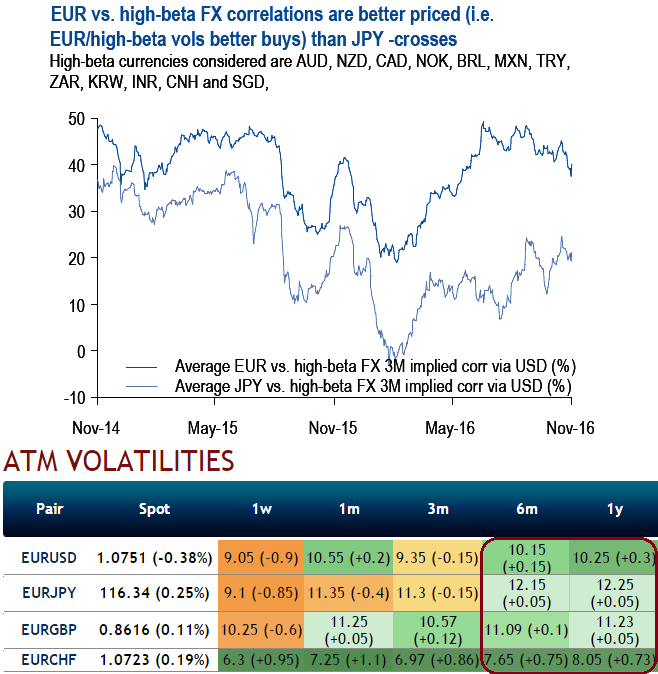

The clean vol expression of the view is to own EUR- and JPY- cross vols against high-beta currencies. The challenge is twofold:

Sourcing these cross vols is non-trivial because of liquidity challenges; and

Trade construction is important , since outright vol buying may not always be feasible on levels, and it may become necessary to buy either risk reversals in lieu of ATM vols or spreads of high-beta vols against their lower beta brethren (e.g. AUDJPY vs. EURJPY gamma spreads recommended as a pre-election hedge) for entry level and carry-efficiency reasons.

EUR-cross vols are better priced at current levels as vol buys than JPY-crosses (see above chart) as investors’ reluctance to own the Euro, even on crosses, remains blatant.

The only EUR- or JPY-cross vol we do not mind selling for financing longs elsewhere is EURJPY, which to our mind will remain trapped between two similar capacity-challenged central banks and comparable sensitivities to US sovereign risk.

We are currently invested in the cross-vol theme via EURINR 1Y ATM straddles.

The FxWirePro euro index creeping up in snail’s pace at 33.7455 points after todays’ GDP and inflation prints in Germany, France and in Euro area.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX