ECB extends asset purchases to end-2017: The monthly pace of purchases, however, will be reduced The ECB on 8 December announced that it would extend the end date of its asset purchase programme by nine months to the end of 2017, more than the six-month extension widely anticipated.

However, it also announced that from April it would reduce its monthly pace of purchases to €60bn from €80bn. The parameters of the programme will also change, enabling it to buy more short-dated securities, which helped to weaken the euro.

From January, the ECB will buy assets in the maturity range of 1-30yrs, compared with 2-30yrs previously, and also assets that yield below the deposit rate (-0.4%).

President Draghi sounded dovish and left open the possibility that asset purchases could be ramped up in the future if downside risks to economic growth materialise or underlying inflation fails to pick up. But if ‘core’ inflation does rise as projected, the ECB may start to wind down asset purchases from 2018.

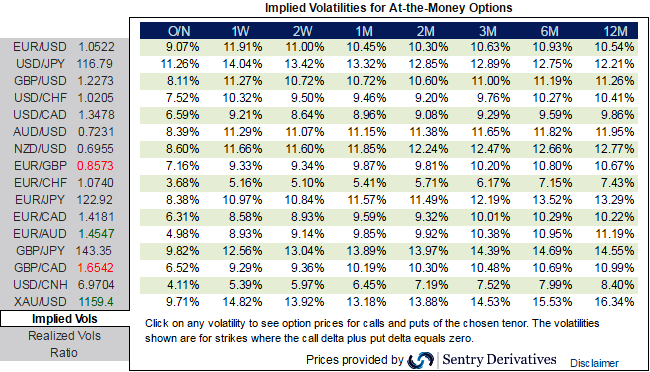

You see higher and steeper 6M-1Y EUR vols: you could make this out from the IV nutshell, rising hedging interests during this span.

Europe faced one constitutional referendum (Italy in December) and three to four national elections next year:

Netherlands in March, France in April/May, Germany by October and possibly Italy.

There are good reasons to think that eventual ballot box outcomes will buck the current populist trend and turn out Euro-benign.

Trump shock will now pull forward that time table, lift 6M-1Y expiry EUR vols that span European election dates, and bull-steepen the vol curve even if shorter- expiry implieds remain well-anchored by tight ranges on spot Euro.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation