The European equities are recording the best earnings data since 2010. The Eurozone benefits from better valuations, improving macro data, fading political risk, slowly normalizing inflation expectations and still-accommodative central bank policy.

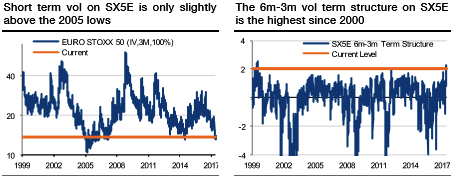

This is reflected in the volatility landscape. The entire VStoxx curve is within 0-5 percentiles of the historical data (since 2010) as shown in the chart below. The short-term volatility on the SX5E is now very close to the lows seen in 2005 when the Citi Economic Surprise Index for Europe was at similar levels as now. Finally, we note that as a result of the difference in sentiment between the short-term complacency around the French parliamentary elections and the medium-term caution around the Italian elections, the 3m-6m term structure has reached its highest level in the past 10 years.

We have, in our recent publications, focused on the bucketing effect in a low vol environment, and this concept has proven very close to actual market behavior. In short, we theorized that in order to cope with increased uncertainty, investors were increasingly focusing on hedging very specific events while choosing to profit by selling risk premium during other periods, leading to a lot of undulations in vol term structure. We expected this phenomenon to amplify as policy uncertainty waned and the economic environment improved, thus making the contrast between normal vol and vol around events even more pronounced.

Well, in a nutshell, relatively better valuations, improving macro data, fading political risk, slowly normalizing inflation expectations and still-accommodative central bank policy have all contributed to lower vol in European equities. Consequently, we recommend buying upside through options

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures