In Europe, the focus will continue to be on political developments in Spain, as the Catalonian parliament is increasingly likely to declare independence in the coming days. Hence, tensions are likely to rise further before improving. We continue to see unilateral secession as highly unlikely. Meanwhile, on the data front, we expect to see a contrasting picture between rising euro-area services PMI.

In the Euro area, Germany election will be held on Sunday. Although Merkel is the strong front-runner to win the election, the key question is who will join the CDU/CSU in the coalition. Although there will be a modest fiscal relaxation worth roughly 0.5%-pt of GDP regardless of the government, the coalition arrangement will have important implications for Germany’s stance toward EU integration.

The EUR uptrend remains intact, but a deeper setback into 1.1510/1.1481 can’t be excluded as long as key-resistance between 1.1918 and 1.2004 is capping the upside.

The bearish forecast reflected the view that the ECB would be quieter on the taper in the near-term. Moreover, markets appeared better prepared for an ECB taper than for the onset of Fed balance sheet normalization, as reflected by already-long EUR positions and overshooting valuations vs. rates, so any rise in yields was expected to be led by the US.

On the other hand, AUD, by contrast, is likely to be weighed down, firstly by its stand-out sensitivity to China sentiment (underlying economic linkages and Australia’s status as a liquid proxy for China), and secondly by the downside risks to RBA policy in Q4’17, including from a housing market that’s not liking its macro-prudential medicine.

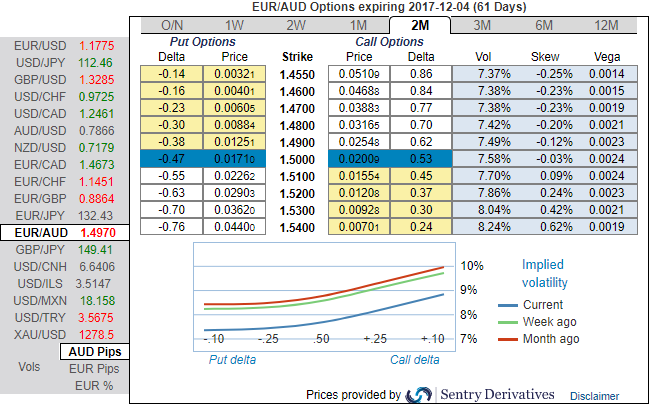

OTC Outlook and Options Strategy: In the case of optionality, the skews of 2m implied volatilities are projected to spike above the current realized (refer above nutshell), positively skewed IVs indicate bidding for hedging upside risks in the underlying spot.

Technically, the risk is essentially pricing in the bearish case, as it is linked to the possibility of volatile Aussie spikes. We articulate the euro’s technical trend against the Aussie dollar in our recent post (refer the same in our technical analysis section).

Thus, contemplating all the above underlying factors of EURAUD, we like being short vol in short run, selling that premium conditionally on a pay-off benefiting from a lower spot.

Prefer a ladder to a call spread ratio As we expect limited spot appreciation and topside volatility, we recommend buying a 2m call ladder. Buy 1 ITM Call of 2m tenor, simultaneously stay short in 1m 1 ATM Call and Sell 1 OTM Call of positive thetas (strikes 1.4735/spot/1.5080).

That structure improves the odds compared to a call spread ratio as the maximum and constant profit zone is reached over a range instead of a single spot level.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data