Cable (GBPUSD) prices plunged below 1.2925/05, and are now consolidating around that level. While the daily momentum still suggests the move can extend towards 1.28 levels. EURGBP has, yet again, tested and failed to break above 0.8840/70 resistance (despite GBP trading through supports against the USD, JPY, CHF and CAD). While below this resistance, we are likely to consolidate further. The broader perspective still favours a move to the downside. A retreat through 0.8725 is needed to confirm a deeper pullback towards 0.8680/20 medium-term support.

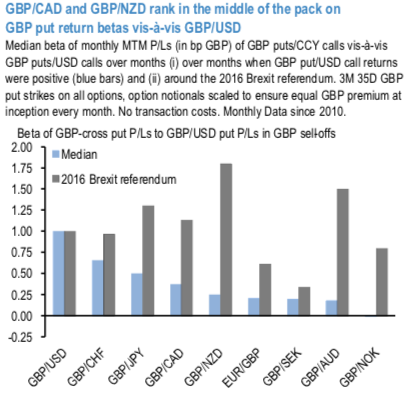

Onto other crosses, the above 1st chart exhibits monthly return betas of GBP put options across G10 vis-à-vis those of GBP puts/USD calls over two sub-samples:

a) all months when GBPUSD put returns were positive, and

b) May- June of 2016 around the Brexit referendum.

For now, we foresee a 40% likelihood of a no-deal Brexit. An important reason for the overall robust development of GBP over the last quarters is also that the British economy has survived the initial shock of the Brexit decision far better than expected. As a result, the Bank of England (BoE) was able to focus much more on the inflationary risks.

The market has always ignored the fact that all the current BoE interest rate moves are due to a favourable result of the Brexit process.

Amid these fundamental driving forces, both the speculators and hedgers of GBP are capitalizing on the prevailing price rallies for further bearish risks as the positively skewed implied volatilities of 2m tenors (refer above nutshells) still signal bearish hedging sentiments. To substantiate this downside risk sentiment, negative risk reversals indicate mounting bearish sentiments.

GBPCHF and GBPJPY have the highest median betas to GBPUSD as anticipated, (and even then, less than 1); GBPCAD and GBPNZD are interesting mid-table entries that rank ahead of even a liquid GBP-cross such as EURGBP. The even more noteworthy numbers are the return betas around the Brexit referendum event: GBPNZD, GBPAUD and to a lesser extent GBPCAD puts were the standout performers on that occasion, in part because GBP-weakness remained a localized event without broader risk market spillovers, and partly due to benign option pricing, ostensibly for similar reasons that their riskies are subdued today.

All considered, GBPNZD could be a left-field choice as a short GBP play, though we would certainly not recommend it as the first Brexit hedge in a portfolio before baseline GBPUSD structures have been put in place.

For instance, one could consider 3M 1.85 strike GBP put/NZD call one-touches that cost 18 % GBP indic. (spot ref. 1.9740) that stand to multiply 3x in premium if spot were to return to its June lows over the next 4-6 weeks. Or more palatably perhaps given the firmness in oil prices, 3M 1.59 strike.

GBP put / CAD call one-touches (same out-of-the- moneyness as 1.2275 strike GBP puts/USD calls) for 19% GBP (spot ref. 1.6840).

Currency Strength Index: FxWirePro's hourly GBP is flashing at -116 (bearish), hourly EUR spot index is flashing at -33 (bearish), while hourly CAD spot index was at 23 (mildly bullish) and USD at 49 (bullish) while articulating at 12:25 GMT. For more details on the index, please refer below weblink:

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed