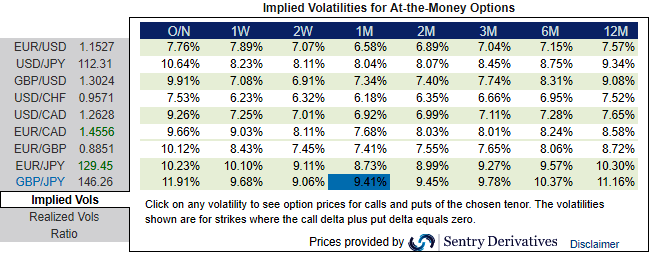

In this write-up, we emphasize on GBPJPY IVs that are highest among G7 FX space.

Please be noted that the nutshell showing the positively skewed IVs of GBP against JPY options has been showing well-balanced risks both upside and downside in 1m-3m tenors, to indicate both puts and calls have been fairly priced in.

Whereas IVs of these tenors are just shy above 9.65% which is highest among G10 currency space, while higher IVs with positively skewed IVs signify the hedgers’ interest for both OTM call/put strikes. In usual circumstances, long option position needs higher IVs for significant change in vega. Hence, we capitalize on buzzing IVs and improve odds on options below strategy.

Options with a higher IV cost more. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good.

Thus, we advocate weighing up above aspects in below option strategy, we eye on loading up with fresh vega longs for long term hedging, more number of longs comprising of ATM instruments and OTM call shorts in short term would optimize the strategy.

The aggressive volatility investors want to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility.

Further GBPJPY upswings and/or abrupt weakness suggest building a directional strategies and volatility patterns at the same time.

Contemplating IV skewness and ongoing technical trend in the consolidation phase, we foresee the value of OTM calls would likely rise significantly as the IVs seem to be favoring long legs of ATM strikes.

As a result, we believe in jacking up in long leg of the below option strategy:

Initiate longs of 2 lots of 1m at the money gamma call options, simultaneously, add long in 1 lot of at the money -0.49 delta put of 2m expiry. It is advisable to prefer European style options.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -152 levels (which is extremely bearish), while hourly JPY spot index was at shy above -22 (bearish) at the time of articulating (at 07:52 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure