The recent data flow is mixed, but Fed hike by year-end remains likely. Some softer news on core inflation and jobless claims. The housing recovery likely to continue and we still have hope for factory sector improvement. Busy data flow this week unlikely to change near-term Fed policy but little turbulence in FX OTC markets (especially the ATM IVs of USDCAD has spiked firmly).

Directional USD strength via call flies in CAD, SGD Medium-term directional risks around USDCAD appear to have shifted higher after this week’s BoC meeting.

While BoC's roller-coaster event ends dovishly in last week, focused on limited lift from CAD depreciation.

The CAD strategists’ take on Poloz’s press conference is that there is evidently a shift in the skew of risks towards more CAD weakness, in particular with an increased upside USDCAD sensitivity to export or other cyclical growth disappointments, though there are decent odds of spot remaining capped in the short term as there is already a material risk premium in the currency in comparison with contemporaneous the US – Canada rate spreads and oil prices.

Given the vol surface set-up, we see two possible option constructs to play the resulting grind higher in USD/CAD:

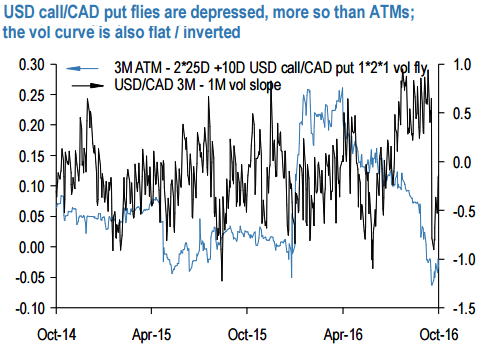

i) USD call/CAD put vol flies are severely depressed, much more so than ATMs (see above chart); 1*2*1 USD call/CAD put flies are therefore natural expressions of slow and steady CAD weakness.

For instance, a 3M 1.33 /1.36 with 1.39 RKI/1.39 USD call/CAD put 1*2*1 butterfly (at spot ref: 1.3342), and delivers 4 times maximum payout ratio if the RKI triggers, 9.5 times if it does not.

ii) As an alternative, one could also short shorter-dated strangles to finance the purchase of longer-dated USD call spreads and exploit the inversion of the term structure.

For instance, one could mull over shorting 1M 1.29/1.35 strangles to finance the purchase of 3M 1.33/1.36 call spreads (again at spot ref: 1.3342), a nearly 75% cost savings to buying the standalone call spread.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons